Barington Capital Pressures Matthews International (MATW) on Strategy, Debt, and CEO Performance in Intensifying Governance Fight

November 17, 2025

Mr. Alvaro Garcia-Tunon

Chairman of the Board of Directors

Matthews International Corporation

Two NorthShore Center

Pittsburgh, PA 15212

Dear Mr. Garcia-Tunon:

Barington Capital Group, L.P. and certain of its affiliates (collectively, “Barington”) have been shareholders of Matthews International Corporation (“Matthews” or the “Company”) since April 2022. We currently beneficially own 1,000,000 shares of the Company’s common stock, constituting over 3.2% of the outstanding shares.

We were pleased to learn last week that Matthews finally signed a definitive agreement to sell its Warehouse Automation business, a long-overdue transaction that we have encouraged the Company to pursue since 2022. While this divestiture is a step in the right direction, we believe that much more remains to be done

to improve the Company’s financial and share price performance.

We invested in Matthews because we are convinced that the Company has a vast value potential that is not being realized. Unfortunately, under the leadership of Joseph Bartolacci, who has served as President and Chief Executive Officer since 2006, we believe that Matthews has deteriorated from a respected memorialization company with a strong market position into a chronic underperformer mired in strategic drift and burdened by excessive debt and spending.

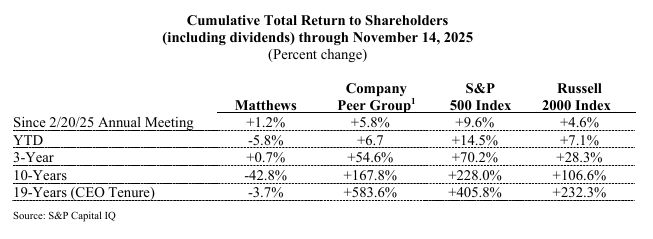

The Company’s common stock (including dividends) has significantly underperformed its self-selected peers and the market as a whole over Mr. Bartolacci’s entire 19-year tenure as CEO. As shown in the table below, this underperformance has continued since the Company’s 2025 Annual Meeting of Shareholders, despite repeated statements regarding the Board’s ongoing “commitment to shareholder value creation”:

Furthermore, Matthews’ balance sheet has deteriorated during Mr. Bartolacci’s 19-year tenure. Even when estimating the impact of the Warehouse Automation transaction, net debt to EBITDA increased from 0.9x on September 30, 2006 to approximately 3.8x as of June 30, 2025.2 Matthews is of the more highly leveraged companies among its Peer Group.3 Similarly, a comparison of Matthews’ SG&A with the median of its Peer Group suggests a $100 million cost reduction opportunity, double the Company’s $50 million target.4

Over the past three and a half years Barington has sought multiple ways to assist the Company in improving long-term shareholder value and reverse its prolonged underperformance. This included providing management with a detailed strategic plan and agreeing to serve as an advisor to the Company from December 2022 to October 2024. Despite our success in helping numerous companies enhance long-term value, Mr. Bartolacci and the Board kept us at arm’s length while we served as an advisor, limiting interactions with us to quarterly meetings with management and a single presentation to the Board during which not one question was asked.

After nearly two years of inaction and minimal progress on our recommendations, we reluctantly concluded that more decisive action was necessary. We therefore commenced a proxy solicitation seeking representation on the Matthews Board and nominated three highly qualified directors for election at the 2025 Annual Meeting. Notably, all three leading proxy advisory firms – ISS, Glass Lewis and Egan-Jones – unanimously recommended that shareholders vote for all of our experienced director nominees. Despite this overwhelming validation, the incumbent Board fought aggressively to prevent our candidates from being elected and to keep Mr. Bartolacci in office. In doing so, the Board made a series of last-minute announcements, including commitments to make long overdue corporate governance improvements, future changes to the Board’s composition, the sale of the SGK Brand Solutions division, and a pledge to explore additional strategic initiatives to enhance shareholder value – culminating in the Warehouse Automation divestiture announced last week.

As you know, over the course of this year, we have increased the size of our investment in Matthews and continued to meet with you and members of management. In our discussions, we have reiterated the need for the Company to move more decisively to improve the Company’s long-term performance and shared our intention to again nominate a slate of highly qualified director candidates for election at the 2026 Annual Meeting.

While we are encouraged by the Company’s recent announcement, it seems to us that Matthews only acts decisively when under the spotlight as a result of our ongoing engagement. Given the Company’s disastrous performance during Mr. Bartolacci’s tenure, it appears that these actions are reactive steps taken to placate shareholders and preserve current leadership rather than part of a cohesive, long-term strategy.

As significant, long-term shareholders, we remain fully committed to helping Matthews unlock its substantial value potential and are concerned that progress will stall without our continued involvement. Barington has substantial experience investing in manufacturing and consumer companies, and we have developed a deep understanding of Matthews’ businesses, as Mr. Bartolacci acknowledged during our May 6th meeting. We believe that our director nominees can provide significant value to the Company and its management team while ensuring that shareholder interests are appropriately represented in the boardroom. We hope to discuss with you a path to add our nominees to the Board without the need for another proxy solicitation.

Sincerely yours,

James Mitarotonda

Chairman and CEO

Member discussion