BILL Holdings (BILL): Barington Capital Presses for Cost Cuts and Strategic Alternatives Amid Sharp Shareholder Underperformance

December 4, 2025

Ms. Allie Kline

Lead Independent Director

BILL Holdings, Inc.

6220 America Center Drive, Suite 100

San Jose, CA 95002

Dear Ms. Kline:

Barington Capital Group, L.P. and its affiliates (“Barington” or “we”) are shareholders of BILL Holdings, Inc. (“BILL” or the “Company”). Barington has a long history of investing in undervalued small and mid-cap public companies and taking an active role in helping them maximize long-term shareholder value. We invested in BILL because we believe that the Company has built a strong financial

operations platform whose intrinsic value – while not currently reflected in its stock price – can be unlocked through decisive action by the Board.

I. Strong Fundamentals and Favorable Strategic Position

We believe the Company is well positioned in the growing business-to-business (“B2B”) financial automation space, serving a substantial and expanding base of small and mid-sized businesses (“SMBs”). The Company currently serves close to 500,000 customers, participates in a network of approximately 8.3 million members, and processes over $350bn in total payment volume, which has been growing at a healthy rate of 10%-15% year-over-year.1 BILL also enjoys a diversified revenue base consisting of recurring SaaS-based subscription fees, volume-based transaction fees and float revenue, high 80%+ gross margins, and a strong net-cash balance sheet.2 Furthermore, the Company has benefited from strategic acquisitions and partnerships that have expanded its suite of offerings and broadened its channel opportunities.

II. Despite These Strengths, Shareholders Have Endured Severe Underperformance

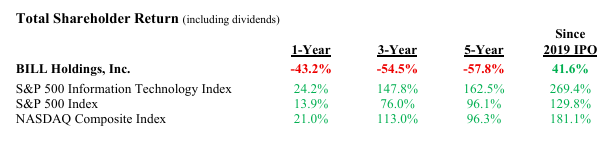

Notwithstanding the Company’s impressive attributes, shareholders have suffered a multi-year period of significant value erosion. As illustrated in the table below, BILL’s total shareholder return has significantly lagged its information technology peers and the broader market since the Company’s initial public offering (“IPO”) in December 2019:

We believe the Company’s disappointing share price performance reflects growing investor concern regarding BILL’s decelerating monetization trends and prolonged inability to deliver operating profitability. BILL’s take rate growth4 – which has slowed to a run rate of 3.5%+ year-over-year, down from 10-15% in 20245 – has likely contributed to a loss of confidence in the Company’s long-term revenue growth and earnings potential.

At the same time, competition in the B2B payments and financial automation space has intensified. Smaller rivals are offering lower-cost solutions, while larger financial software providers have begun integrating payments capabilities directly into their platforms. With the Company experiencing slower customer monetization trends, stockholders are questioning whether BILL can remain a long-term leader as an independent company and continue to gain market share.

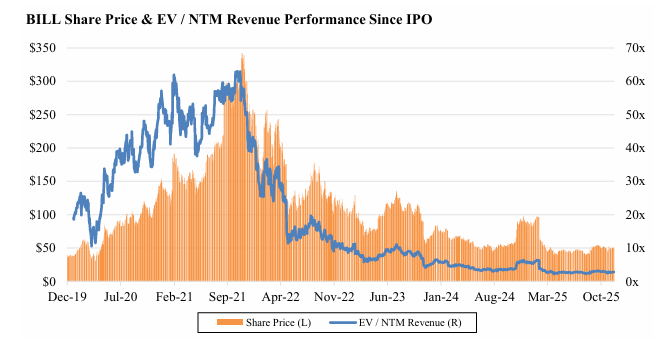

Reflecting these concerns, BILL’s valuation has compressed dramatically. As can be seen in the chart below, BILL’s common stock is currently trading over 85% below its record high of $342 per share reached in November 2021 and is now valued at just 2.8x next twelve months (“NTM”) revenue, near its lowest level in the Company’s history.

III. The Board’s Recent Refresh Creates an Opportunity for Meaningful Change

We commend the Company for entering into a cooperation agreement with Starboard Value and adding four new independent directors to the Board. This creates an opportune moment for the Board to take a fresh, objective look at the Company’s strategic direction, cost structure and long-term path to value creation.

To that end, we wanted to share our views on two critical steps we recommend the Company promptly take to improve long-term shareholder value:

- Implement a Comprehensive Cost-Reduction Program

In our opinion, the Company’s operating expenses have expanded well beyond what is necessary to support efficient, sustainable growth. Since BILL began publicly reporting its financial performance in 2019, the Company has not delivered a single quarter of positive GAAP operating income.7

While heavy investment was appropriate during BILL’s early growth phase, with growth now decelerating, however, we believe the Company should rationalize spending across its research and development (R&D), marketing and general and administrative (G&A) functions to better align its expense base with market realities. We believe this is particularly important now, given that the Company’s high margin float revenue, which currently runs at approximately 10% of total revenue, is likely to decline as the Federal Reserve continues to reduce interest rates.8 We therefore urge the Board to ensure that management is operating the business with greater cost discipline, so that BILL can better leverage its revenue growth to generate increased profits and stronger cash flows.

- Simultaneously Explore all Strategic Alternatives for the Company

While we see the potential for continued upside in BILL’s operating performance as an independent company, the public markets appear unwilling to assign a fair valuation to the Company’s technology leadership, customer network and long-term prospects. By contrast, the private markets have ascribed significantly higher valuations to companies with similar business models and growth profiles.

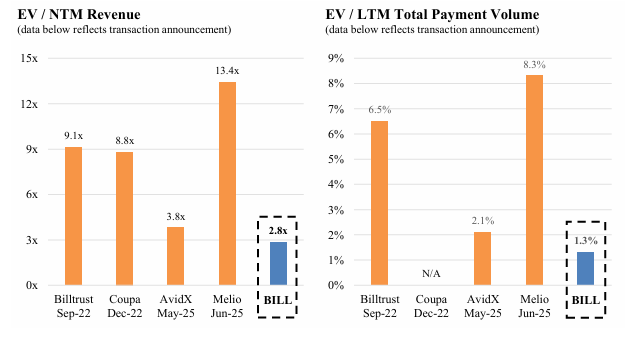

Since 2022, four of BILL’s peers – Billtrust, Coupa Software, AvidXchange and Melio – elected to pursue private market alternatives to maximize shareholder value. As can be seen in the charts below, these four transactions delivered substantially higher multiples on NTM revenue and last twelve months (“LTM”) total payment volume relative to the Company’s current multiples:9 10

Based on our research, it is our belief that the Company would be an extremely attractive acquisition candidate for both strategic and financial buyers. Among other things, we believe the Company’s large payments network, high gross margins and scalable business model would be highly appealing to a wide range of private equity acquirers seeking consistent and resilient cash flows, while its leadership position in B2B financial automation and embedded-finance capabilities makes it a compelling acquisition candidate for strategic consolidators seeking tovexpand into SMB-focused payments and workflow software. We therefore strongly urge the Board to engage a financial advisor and form a special committee of independent directors to explore strategic alternatives for the Company, including a potential sale, merger or other business combination.

We should note that pursuing a cost-reduction program and exploring strategic alternatives are not mutually exclusive actions. In our view, they are mutually reinforcing: a more efficient BILL will inevitably command a higher price in a sale process, while cost improvements will benefit shareholders, both during the strategic review process and thereafter should the Board elect to keep the Company independent.

IV. Conclusion

We believe BILL is a world-class financial operations platform at a pivotal crossroads. Without meaningful changes to its cost structure and strategic trajectory, BILL risks continuing its pattern of underperformance in the public markets.

The recent Board refresh, combined with the Company’s excellent assets, creates an opportunity for decisive steps to be taken to improve long-term shareholder value. We urge the Board to seize this moment to reduce costs, explore strategic alternatives and pursue a path that will maximize value for all shareholders.

We appreciate your consideration of our recommendations, which we are available to discuss further at your earliest convenience.

Sincerely yours,

James Mitarotonda

Chairman and Chief Executive Officer

Member discussion