Findell Capital Challenges Oportun Financial (OPRT) Board, Cites Governance Failures and Urges Election of Lending Expert Warren Wilcox

Findell Capital Provides Facts in Response to Oportun’s Misleading Narrative

NEWS PROVIDED BY

Findell Capital Management, LLC

Jun 13, 2025, 08:06 ET

Highlights that the Improvement in the Company’s OpEx per Loan Was Driven by Findell’s Advocacy and its Identified Director Appointments – Not by Management or the Current Board

Reiterates its Belief That Additional Independence and Consumer Finance Industry Expertise Is Urgently Needed in the Boardroom to Achieve Oportun’s Full Potential

NEW YORK, June 13, 2025 /PRNewswire/ -- Findell Capital Partners, LP today issued the below letter to its fellow stockholders of Oportun Financial Corporation (NADSAQ: OPRT) (“Oportun” or the “Company”) to address the misleading statements included in Oportun’s recent materials.

Fellow Stockholders,

Findell Capital Partners, LP (together with its affiliates, “Findell,” “we” or “us”) is the beneficial owner of approximately 7.4% of the outstanding common shares of Oportun Financial Corporation (“Oportun” or the “Company”), making us a top two stockholder. Given our multi-year investment in the Company and our involvement in the successful addition of independent lending experts Scott Parker and Richard Tambor to the Board of Directors (the “Board”) in 2024, we are intimately familiar with the operational and governance issues that are preventing Oportun from achieving its full potential.

At the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) on July 18, we are seeking to elect Warren Wilcox to the Board to strengthen independent oversight of management and ensure the Board is no longer controlled by long-tenured directors resistant to change. Mr. Wilcox is a consumer finance and lending industry veteran who has no ties to Findell and whose appointment would, we believe, empower the Board to effectively oversee the business after years of what we can only describe as value-destructive acquisitions, slow operational improvements and entrenchment maneuvers.

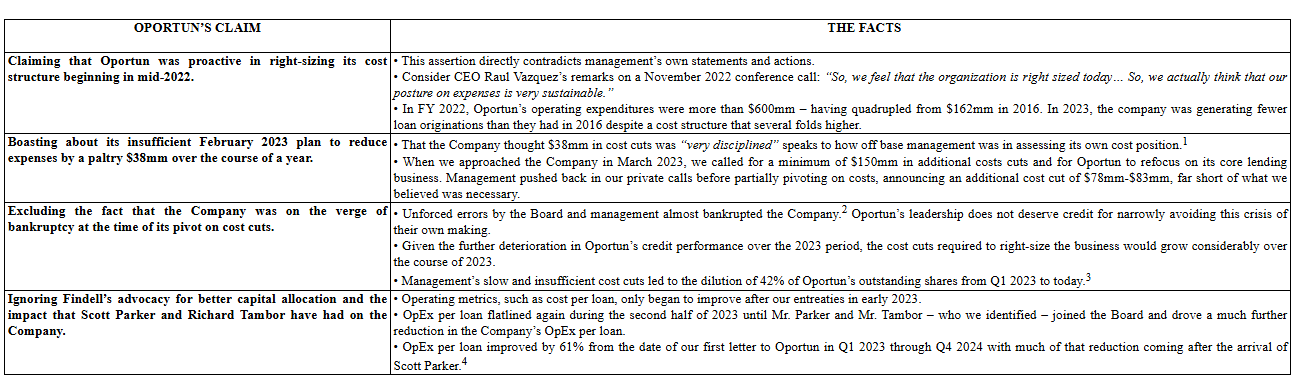

Recent communications from Oportun, including the June 12th letter from outgoing Lead Independent Director Neil Williams, apparently attempt to rewrite the Company’s history. We want to correct what we see as clearly false and misleading statements made by Oportun so you can make an informed decision at the Annual Meeting:

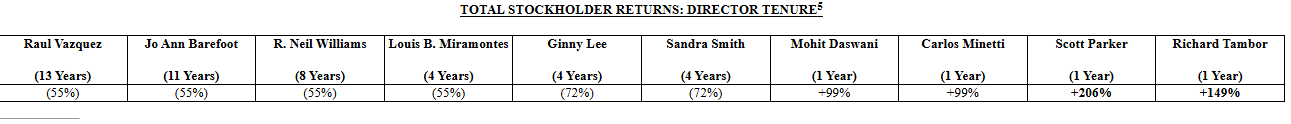

The attempts by the legacy Board members to take credit for these improvements are, in our view, part of a transparent effort to maintain their positions, despite a track record of poor total stockholder returns. The facts speak for themselves: the turnaround in Oportun’s operations is directly tied Findell’s engagement and the addition of Mr. Parker and Mr. Tambor.

1 During Oportun’s Q4 2022 earnings call, CFO Jonathan Coblentz said the Company was “very disciplined about OpEx.”

2 As indicated by the company’s share price and deteriorating operating performance during 2023 and early 2024.

3 Company’s weighted average shares outstanding including warrants as reported on Form 10-Q.

4 Company financial reports on Form 10-Q, Bloomberg.

5 Company proxy statement filed May 28, 2025 and Bloomberg. Total stockholder returns as of 6/12/2025.

Oportun is a great lending business. We are confident that strengthening the Board with directors who have lending experience and are capable of providing independent oversight will drive the Company to new heights. Allowing the legacy directors, who have no lending experience, to retain majority control of the Board will only put Oportun at long-term risk. The choice for stockholders is that simple.

By voting for Mr. Wilcox, you will not only elect someone with a lifetime of experience in consumer lending, but you will also ensure that the future of your investment is not in the hands of entrenched Board members who have destroyed significant value and allowed management to make numerous strategic errors without accountability. We urge you to vote on the WHITE proxy card today to elect Mr. Wilcox.

Sincerely,

/s/ Brian Finn

Brian Finn

CIO

Findell Capital

Source:

https://www.sec.gov/Archives/edgar/data/1538716/000092189525001760/dfan14a13982002_06132025.htm

Member discussion