Hartman Shareholder Alliance Blasts Silver Star Properties REIT (SLVS) for Mismanaged Asset Sales, Urges Vote for Disciplined Liquidation and Capital Return

June 17, 2025

When Assets Are Mismanaged, Shareholders Pay the Price

Dear Fellow Shareholder,

Let’s look at the facts — and what they reveal.

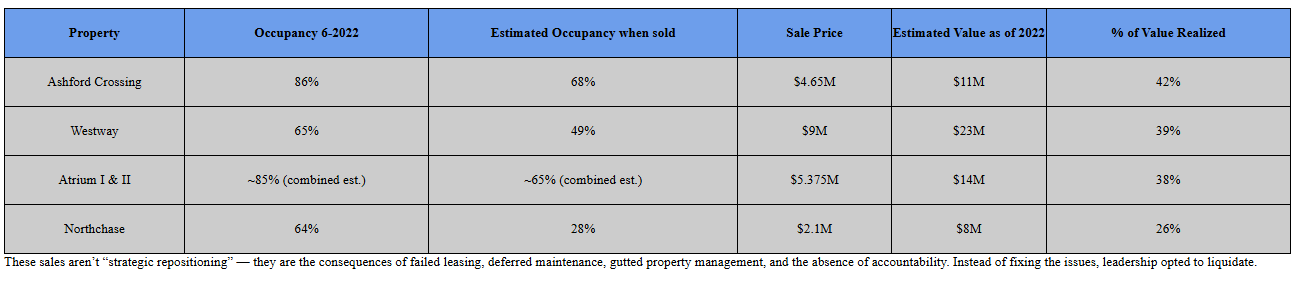

In June 2022, just two months before Al Hartman was removed as CEO (August 2022), key office properties were stabilized and generating strong rental income. But under new leadership, occupancy collapsed and the properties realized sales value often lower than what was paid 10+ years ago. These were not distressed assets; they became distressed through neglect and mismanagement.

Our path is different.

We believe in experienced management, clear financial reporting, and returning capital to shareholders — not squandering it through rushed, below-market asset sales.

Let’s stop this pattern before more value is lost.

Vote the BLUE card to elect Longnecker, Thomas, and Hartman directors who will focus on a disciplined liquidation of the company and a return of capital to the shareholders.

Sincerely,

Al Hartman

The Hartman Shareholder Alliance

Source:

https://www.sec.gov/Archives/edgar/data/831616/000110465925060299/tm2518260d1_dfan14a.htm

Member discussion