UniFirst Corporation (UNF): Engine Capital Slams Governance Failures and Urges Immediate Strategic Review, Including a Potential Sale

UniFirst Corporation

68 Jonspin Road

Wilmington, Massachusetts 01887

Attention: Joseph M. Nowicki, Sergio A. Pupkin, Raymond C. Zemlin, Cecilia McKenney, Michael Iandoli (the “Independent Directors”)

Dear Independent Directors,

Since UniFirst released its Q4 2025 results, issued a disappointing 2026 outlook, and our director nomination became public, shareholders and sell-side analysts have overwhelmingly echoed Engine’s thesis: the status quo at UniFirst is untenable. A few recent public examples include:

· River Road Asset Management, in a letter to the Company’s Board of Directors (the “Board”) attached to a Schedule 13D filed on November 25, 2025, expressed profound disappointment with the Board’s decisions and support for Engine’s views.

· Barclays published an equity research report on November 26, 2025 titled, “Dear Board, our perspective on why we agree with Engine Capital…”. The report discusses Barclays’ belief that a strategic sale is the optimal path given the Company’s disappointing prospects as a standalone entity.

· J.P. Morgan published an equity research report on October 23, 2025, stating that: “UniFirst continues to lack a detailed, cohesive, publicly-articulated strategy for returning the business towards mid-single digit % revenue growth and high teens % EBITDA margins. We have written in the past that UniFirst’s decision to reject Cintas’ unsolicited takeout offer ‘puts the shortest route to maximum shareholder value creation in the rearview mirror.’ Today’s results suggest that the alternative path may prove bumpy and winding.”

Public support for an activist at this scale is extraordinarily rare and seems to be a direct reflection of shareholders’ extreme frustration with the direction of the Company under the oversight of the Board and the control of the Croatti family. At this stage, it should be evident to you that a substantial majority of shareholders are not supportive of the Company’s current direction under your leadership. This should deeply concern each of you. Every director – including directors nominated by Class B Common Stock shareholders – has the same fiduciary duty: to act in the best interests of ALL shareholders, not just the Croatti family. The fact that UniFirst is a controlled company does not diminish these duties, nor does it justify operating as if the common stock shareholders – who have a minority of the voting power but most of the economic ownership – do not matter.

A specific and immediate concern relates to your ability to fulfill your fiduciary duties. UniFirst’s General Counsel, Michael Patrick, plays a central role in advising the Board, selecting and coordinating outside counsel, and shaping what the Board hears from its advisors. Mr. Patrick is also Cynthia Croatti’s stepson. That is a material conflict. No board should rely on advice that flows through a conflicted gatekeeper. The Board should immediately form a Special Committee of independent directors with its own independent legal counsel and financial advisor to protect the independence and confidentiality of their deliberations. Maybe if you were properly advised, you would not have endorsed (i) an unusually accelerated annual meeting date, (ii) a virtual-only meeting format, and (iii) a process that leaves shareholders with minimal time between the filing of the definitive proxy and the vote.

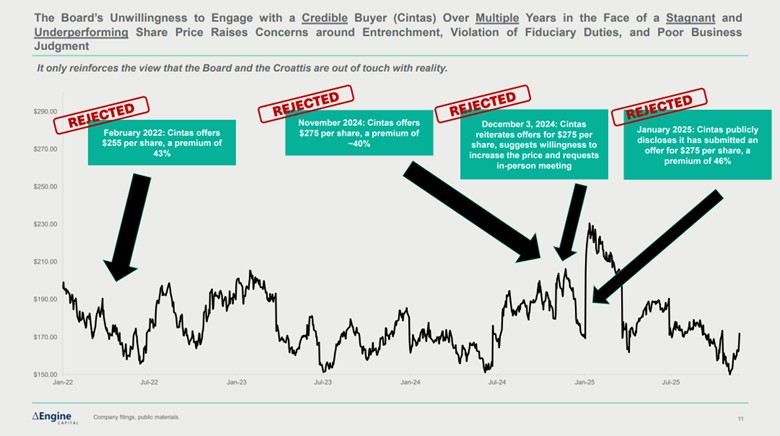

We are also troubled by the Board’s longstanding refusal to engage constructively with potential buyers, including Cintas Corporation (“Cintas”) and Elis SA, despite the absence of a credible standalone plan that would deliver superior value.

The Board and the Croatti family should consider the following thought experiment. On February 7, 2022, Cintas offered $255 per share – a 43% premium at the time. If the Board had agreed to that price (we suspect the Board could have negotiated a higher price) and the Croatti family had elected to take Cintas stock, their shares would be worth today the equivalent of ~$518 per UniFirst share, given that Cintas has generated a total shareholder return of 103% (through share price appreciation and dividends) since then. Instead, UniFirst trades around $160 per share. As the Company’s own long-term performance demonstrates, the decision to reject strategic interest has come at an extraordinary cost to shareholders, including the Croatti family. The Croatti family’s stake, which is worth today around $568 million, would have been worth close to $1.84 billion, a staggering ~$1.3 billion mistake. The Board and the Croatti family are making the same mistake again today by not immediately initiating a strategic review process.

Former employees who knew former CEO and President Ron Croatti well told us repeatedly that making smart financial decisions for the benefit of the family and especially his children was so important to him. He would be devastated by the poor financial decisions repeatedly made by his wife, Carol, and his son, Matthew.

As independent directors, we believe you need to ask yourselves a difficult question: why continue supporting decisions that are clearly destroying shareholder value and hurting your own reputation? Each of you is paid approximately $300,000 per year to serve on this Board. But no level of compensation can offset the reputational damage that comes from being seen as passive participants in value-destructive decisions. As we expressed privately, we believe this situation is solvable. If the independent directors – together with CEO Steven Sintros – were to engage Carol and Matthew with a united message that pursuing a sale is the most responsible path for the Company and for all shareholders, we believe that message would be heard. If the alternative were the collective resignation of the independent directors and the CEO, we are confident that the Trustees would recognize the gravity of the moment and agree to run a sale process.

In other words, you are not powerless. You have agency, and right now your agency is the most important variable in determining whether value continues to erode or UniFirst finally pursues a path that maximizes value for every shareholder.

You face a choice:

· Stay on the current trajectory – and remain complicit in decisions that shareholders and analysts overwhelmingly agree are destroying value; or

· Exercise the responsibility that comes with your role, act in the best interests of all shareholders, and insist on a process that evaluates a sale of the Company.

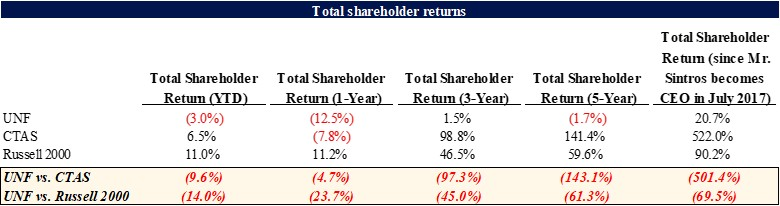

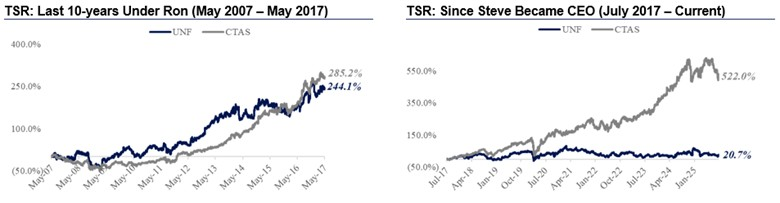

Fundamentally, UniFirst’s governance structure is broken. While the dual-class share structure may have been defensible under Ron Croatti’s exceptional leadership, it can no longer be justified. The reality today is that UniFirst is no longer a family-run business. It is a regular publicly traded corporation overseen by a professional management team. We have heard repeatedly from former employees that the “family culture” that once characterized UniFirst effectively ended with Ron’s passing. In other words, the dual-class structure is no longer preserving family values – it is simply preserving control. And that control has become a barrier to accountability, strategic clarity, and value creation. The results speak for themselves. As the below charts demonstrate, the dual-class structure has not protected value – it has destroyed it. If UniFirst operated under a modern governance structure, the Board and management would have been refreshed years ago – or, more likely, the Company would have been sold at a significant premium.1

Total shareholder returns calculated as of the close on October 22, 2025.

Rather than engaging in a multi-year public battle – a process that will inevitably end with representatives chosen by common stock shareholders being elected to the Board at the Company’s contested 2028 annual meeting – we believe it would be far more constructive to work together now, add a shareholder representative immediately, and focus on maximizing the value of the Croatti family’s life’s work.

Sincerely,

Arnaud Ajdler

Managing Member

Engine Capital LP

Source: https://www.sec.gov/Archives/edgar/data/717954/000092189525003225/ex991dfan14a09488unf_120125.htm

Member discussion