180 Degree Capital (TURN): Marlton Partners Nominates Directors, Criticizes Kevin Rendino for Value Destruction and NAV Discount

Dear Fellow Shareholders,

Since Kevin Rendino became the Chair and CEO of 180 Degree Capital Corp. (“TURN” or “Company”) in 2017, net asset value has fallen -37.3%.1 Meanwhile, TURN’s self-selected benchmarks, the Russell Microcap, Russell Microcap Value, and Russell 2000 Indices, are up +59.2%, +70.5%, +82.1%, respectively.2 By the end of November 2024, the fund’s discount to net asset value (“NAV”) stood at -26%.3

Eliminating this discount would immediately create over $12.5 million in value for the Company’s shareholders on a traded market capitalization of $36m.4

Marlton Partners L.P. (together with its affiliates, “Marlton” or “we”) first engaged with TURN in October of 2023, suggesting to Mr. Kevin Rendino, CEO and Chairman, and Mr. Daniel B. Wolfe, President, that the Company implement a Discount Management Program (“Program”).5 At the core of our proposal was a Conditionally Triggered Tender Offer, which would guarantee shareholders an exit in cash at or near NAV by a tender offer for 12.5% - 25% of issued share capital should the discount to NAV be greater than a reasonable threshold. This would provide shareholders with a fair opportunity to realize value, yet the Company responded with an evasive, non-committal program that fails to obligate or guarantee shareholder capital returns at NAV.

On August 27th, 2024 we requested a meeting with Lead Independent Director, Mr. Parker A. Weil, but this was ignored. We think it is telling that no current independent director has purchased stock over the past 2,315 days—6 years—save for Mr. Richard P. Shanley’s modest purchase of 2,000 shares, one year ago, on November 15th, 2023.6

The market has had more than seven years to assess the impact of Mr. Rendino and this Board. The results are clear: absentee oversight has failed shareholders. This failure underscores the urgent need for fresh perspectives, true boardroom independence, and a clear, binding commitment to return capital to shareholders at NAV. Without these changes, TURN's persistent underperformance and widening discount to NAV are unlikely to be resolved.

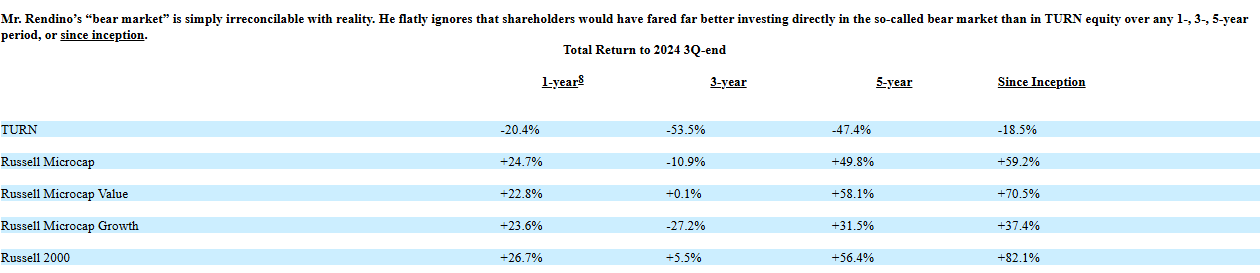

To explain the magnitude of value destruction driven by his ‘boom and bust’ investment approach, coupled with his refusal to return capital, Mr. Rendino has chosen to invent an imaginary bear market in TURN’s asset class. As recently as November 15th 2024, Mr. Rendino told shareholders “[the]bear market for our asset class has lasted far longer and driven valuations down far further than I ever would have thought possible.”7

A dollar invested in TURN under Mr. Rendino’s tenure between 4Q 2016 and the end of 3Q 2024 would be worth only $0.82 versus $1.82 and $1.37 for the best and worst performing benchmark indices respectively.9 That is sobering.

Shareholders deserve, at a minimum, intellectual honesty and accountability. Mr. Rendino and his deferential board have proven incapable of both, with fabulous tales of a fictional bear market.

Marlton has recommended, and continues to recommend, that the Board enact a formal proposal to provide shareholders an exit at NAV immediately. This could be accomplished easily, through multiple means, including but not limited to, distributing the portfolio’s publicly traded securities as a dividend in-kind to shareholders.

The Board and Mr. Rendino have refused to return capital to TURN shareholders, despite having repeatedly returned capital at NAV to investors in separately managed accounts throughout 2024, and as recently as November 27, 2024.10 These investors most recently received a tax efficient exit at NAV through a distribution in-kind of Potbelly Corporation stock. Meanwhile, shareholders of TURN stock, such as you, have been trapped in this serially underperforming vehicle at a substantial discount and paying annual fees approaching 10% of NAV.

Despite this glaring disparity, Mr. Rendino continues to make superficial statements regarding the need to eliminate the NAV discount and increasing the stock price, but has not committed to a binding plan to do either, and has not shown the discipline to accomplish either absent an obligatory plan.

Meanwhile, TURN’s current independent directors are not sufficiently holding management accountable. It is unclear to us if they exert any discernible influence over Mr. Rendino, and they do not seem to be interested in publicly communicating with shareholders. This lack of engagement and accountability is symptomatic of broader governance failures at TURN. The current independent directors’ refusal to directly address shareholder concerns or hold Mr. Rendino accountable only highlights the urgent need for change.

Therefore, we delivered notice to the Company nominating three highly-qualified director candidates for election at the upcoming Annual General Meeting of Shareholders.

At the meeting, we will be seeking to remove several long-serving directors with a history of presiding over TURN’s value-destructive decisions and replace them with new highly-qualified directors who we believe, you will see, have a commitment to shareholder-focused governance, including return of capital to shareholders at or near NAV where appropriate to create shareholder value and optimize for expediency and tax efficiency.

We are confident you will agree, that our proposed director candidates possess the experience and skill sets necessary to drive return of capital results not excuses.

Our goal is simple yet critical: to restore TURN’s credibility, narrow the NAV discount, and ensure that shareholder capital is respected and returned.

The next step will be for you, TURN’s owners, to have a direct say in your Company's future.

Sincerely,

/s/ James C. Elbaor

James C. Elbaor

Managing Member of the General Partner,

Marlton Partners, L.P.

Source:

https://www.sec.gov/Archives/edgar/data/893739/000101359424001018/dfan14a180degree-12172024.htm

Member discussion