ADAR1 Capital Slams Keros Therapeutics (KROS) Strategy, Urges Board Overhaul and Cash Return Amid Pipeline Concerns

Dear Fellow Stockholders,

Keros Therapeutics (“Keros” or the “Company”) is at a crossroads. Two of the Company’s three drug candidates, KER-012 and KER-065, have demonstrated concerning side effects in clinical trials. In our view, any further development would be dilutive to stockholder value and, potentially, put patients at risk.

As Keros’ largest stockholder with approximately 13.3% of the Company’s outstanding shares, ADAR1 Capital Management, LLC (together with its affiliates, “we” or “us”) has been a committed investor for nearly two years, carefully analyzing the Company’s pipeline developments and capital allocation decisions. We have urged Keros to discontinue development of KER-012 and KER-065 and to narrow its focus to deliver value from KER-050 (“elritercept”), which the Company is developing in partnership with Takeda Pharmaceuticals (“Takeda”). We believe that KER-050 has a path to commercialization and could achieve peak sales of more than $2 billion.

Unfortunately, the Company has dismissed our recommendations and continues to operate with what we believe is an excessive cost structure, an unfocused strategy, and an unnecessarily bloated balance sheet with too much cash. Rather than right-sizing its capital structure and concentrating on high-potential opportunities, the Company has persisted with developing programs that we believe are value-destructive.

We invested in Keros because we saw enormous potential. But in our view, that potential is being squandered.

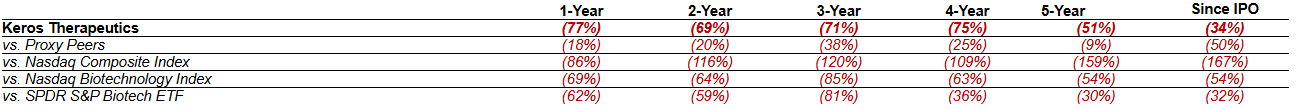

The numbers speak for themselves. Keros has generated negative total stockholder returns across every relevant timeframe since its initial public offering, underperforming its proxy peers and relevant market and biotechnology sector benchmarks.

Source: Bloomberg. Data as of May 6, 2025. “Proxy Peers” include Akero Therapeutics, Arcturus Therapeutics, Crinetics Pharmaceuticals, Editas Medicine, Geron Corp., IDEAYA Biosciences, lovance Biotherapeutics, KalVista Pharmaceuticals, Kura Oncology, Mersana Therapeutics, Morphic Holding, Protagonist Therapeutics, Replimune Group, Rocket Pharmaceuticals, Scholar Rock Holding Corp., Springworks Therapeutics, Syndax Pharmaceuticals and Zentalis Pharmaceuticals. Peer data refers to median.

The Company’s current market value barely reflects our estimate of the net present value of potential milestone payments from the Takeda partnership, suggesting that investors assign zero value to the rest of Keros’ pipeline and believe that the Company will deploy its substantial capital—more than $720 million as of March 31, 2025—on unproductive or misguided initiatives.

We think a new approach is urgently needed and the best path forward for Keros and its stockholders is to:

• Restructure the business and reduce headcount by at least 70%;

• Return excess cash to stockholders, preserving only what is necessary to support high- confidence opportunities; and

• Ensure that stockholders capture the upside from the Takeda partnership through a contingent value right or similar mechanism.

We believe these initiatives could ultimately deliver between $24 and $35 per share in value for stockholders, encompassing net cash value and the net present value of the elritercept partnership. And yet, rather than embracing our recommendations and taking what we believe to be the necessary steps to enhance value, the Board rejected our offer of assistance and appears content to continue down a path that, in our view, is actively destroying shareholder value.

We see no reason to be optimistic about the prospects of KER-012 or KER-065. Without a change in oversight and strategy, we believe the Company’s poor performance and depressed valuation will persist. Keros needs a Board that will ask tough questions, challenge management, and act with a sense of urgency. It is time for accountability.

To that end, we intend to vote “WITHHOLD” on the re-election of Dr. Mary Ann Gray and Dr. Alpna Seth—two directors who have presided over the Company’s challenges—to send a clear message that stockholders are dissatisfied with the Company’s current direction and that meaningful change is necessary.

We also believe that significant stockholders - such as ADAR1 and Pontifax, which owns approximately 11.9% of the Company’s outstanding shares - should have direct representation on the Board to help ensure shareholder interests remain aligned with long-term strategic decision making. Accordingly, we intend to vote “FOR” Ran Nussbaum, the Managing Partner and Co-Founder of Pontifax.

At this Annual Meeting, stockholders have an opportunity to make an unequivocal statement that the Company cannot continue along the same path that has led to significant value destruction.

Sincerely,

Daniel Schneeberger

ADAR1 Capital Management

Source:

https://www.sec.gov/Archives/edgar/data/1664710/000090266425002179/p25-1124exhibite.htm

Member discussion