AJP and Orbic Slam Sonim Technologies (SONM) Board for Rejecting Superior Buyout Offer, Urge Shareholders to Back Board Overhaul

Dear Fellow Stockholders,

Enough is enough. The entrenched Sonim board just turned down another superior offer to acquire substantially all of the assets of Sonim—an offer that would have delivered an immediate and substantial premium to you, the true owners. Instead, they chose to protect their own positions and ignore your best interests. We are calling for immediate change. That is why we are seeking your support to reconstitute the Board with independent, experienced directors who will prioritize stockholder value over self-preservation. This is your chance to take back control and install a Board that works for you, not against you. WE URGE YOU TO VOTE YOUR SHARES ON THE BLUE PROXY CARD FOR THE AJP/ORBIC NOMINEES.

● SONIM’S SPECIAL COMMITTEE FAILED TO ENGAGE WITH ORBIC ON THE REVISED PROPOSAL:

o LACK OF ENGAGEMENT: We believe Sonim’s current board of directors, and the Special Committee has failed to act in your best interests. Despite presenting a credible, fully committed financed offer to acquire substantially all of the assets of Sonim at a significant premium, the Special Committee has again chosen to mischaracterize the validity of our offer without any dialogue with us. In fact, even despite our clearly superior offer and repeated outreach to Sonim, Sonim would not engage in any discussion regarding a potential transaction, citing that it was prevented from doing so due to exclusivity granted to Social Mobile®. Sonim has not demonstrated that it has made any significant progress on negotiations with Social Mobile® or disclosed to stockholders the length of the exclusivity period. HOW LONG SHOULD YOU BE KEPT IN THE DARK?

o THE REVISED OFFER REPRESENTS A 66.7% PREMIUM: The revised offer represents a 66.7% premium of the amount payable by Social Mobile® at an initial closing of that transaction (and a 25% premium if the earnout feature of the proposed Social Mobile® transaction is achieved). Orbic is prepared to move forward expeditiously with the negotiation of an asset purchase of substantially all of Sonim’s assets. Orbic’s non-binding offer is backed by a $50 million financing commitment from a third-party lender. Sonim’s Special Committee continues to claim that it is committed to maximizing stockholder value; however, they have failed to provide stockholders with the details of how they will achieve the value.

● SONIM HAS YET TO SIGN AGREEMENTS WITH SOCIAL MOBILE® OR ITS UNNAMED ACQUIRER FOR THE SALE OF ITS PUBLIC COMPANY SHELL:

WHERE ARE THE DETAILS?: The Sonim board of directors signed a letter of intent with Social Mobile® over a month ago, however, there has yet to be an agreement signed. WHAT IS TAKING SO LONG? Further, Sonim has still not provided you with any specific details on how the proposed non-binding letter of intent for an asset sale to Social Mobile® or non-binding letter of intent for a proposed sale of Sonim’s public company shell will translate into stockholder value. Sonim’s recent announcements continue to fail to provide sufficiently quantifiable metrics, verifiable data and financial analysis demonstrating how the proposed transactions will deliver tangible benefits. WHAT IS SONIM HIDING?

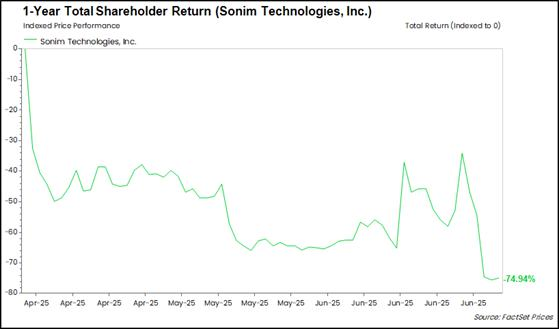

● SONIM’S PRECIPITOUS STOCK PRICE DECLINE HAS DEVASTATED STOCKHOLDER VALUE:

o SONIM’S STOCK PRICE DECLINED BY APPROXIMATELY 74.94%: Sonim’s stock price has continued to decline approximately 74.94% over the three-month period ending on July 3, 2025, sadly as shown in the chart below:

o SONIM’S SHARES SINK AFTER ANOTHER PUBLIC OFFERING: Following the announcement of our revised offer, Sonim’s board of directors undertook another dilutive stock offering, which has further devastated stockholder value and eroded the value of your investment. Sonim offered an additional 7.4 million shares at $0.75 a share, a steep discount to the market price on July 1, 2025, resulting in its stock price plunging by approximately 38%.

o STOCKHOLDERS SHOULD BE FURIOUS: The Sonim board of directors disastrous track record of operating performance and ill-advised financing strategies have continued to destroy stockholder value, all with little to no communication to stockholders. WHY SHOULD STOCKHOLDER’S TRUST SONIM’S BOARD OF DIRECTORS?

● YOU DESERVE BETTER: You deserve better than this. Our slate of nominees will provide Sonim with better leadership to unlock stockholder value.

WE URGE YOU TO VOTE YOUR SHARES ON THE BLUE PROXY CARD FOR THE AJP/ORBIC NOMINEES.

The outcome of the 2025 Annual Meeting will determine whether stockholders will continue to be subject to an underperforming, entrenched and self-interested board of directors and management team or will have a new group of professional leaders that will breathe life into Sonim. We believe that a transformation in leadership is crucial for Sonim’s future success and stockholder value.

AJP and Orbic strongly contend that it is time for an immediate and dramatic change. Sonim stockholders deserve strong, capable and open-minded directors, such as the AJP/Orbic nominees, who have the experience and desire to explore every opportunity to unlock stockholder value and return Sonim to profitability.

We need your help to unseat Sonim’s incumbent board of directors by electing the AJP/Orbic nominees. A lot rides on your vote and every vote matters! VOTE YOUR SHARES ON THE BLUE PROXY CARD IN FAVOR OF THE AJP/ORBIC NOMINEES.

Respectfully,

Parveen (Mike) Narula,

on behalf of AJP Holding Company, LLC

-and-

Orbic North America, LLC

Source:

https://www.sec.gov/Archives/edgar/data/1178697/000121390025062266/ea0248429-dfan14a_ajphold.htm

Member discussion