Al Hartman Urges Silver Star Properties (SLVS) Shareholders to Support Takeover Bid, Blasts Current Leadership for $278M NAV Decline and Mismanagement

Dear Shareholders,

Our vision is to take the Silver Star Properties REIT, Inc. (the “Company”) over before the current Directors and Management further destroy the value of your investment. Their plan is to risk your investment on an unproven investment thesis, award themselves cash, fees, and stock, and tie up your capital for years. Ours is simply to sell, stabilize, and return your capital. We will sell the Walgreens and mini storage immediately and start returning your capital to you as soon as those properties sell, perhaps as soon as this year. We believe that we can create enough value with the legacy assets to return close to all your capital when including the distributions you have already received.

I am writing to you today to request your vote in the proxy solicitation that will be sent to you next week.

The reason that I believe I have earned your support is the following:

- According to The Stanger Report, in 2021 the Company had the #1 5-year track record among all non-traded REITs in terms of cash flow and appreciation. (see attached)

- Portfolio occupancy at the time of my removal was 81%, and was projected to reach 85% based upon end of year budget 2022. (Q3 2022 occupancy numbers can be found here)

- The properties were well maintained, had no deferred maintenance, as we spent $13M per year on property improvements, and had six engineering managers working full time to keep the properties well maintained. The properties were so well maintained that great profits were made from property sales by the company within the first 6 months of ‘23 after I left. In fact, there was a $27M profit made by the company in the first quarter alone.

- Hartman vREIT XXI, Inc., a comparable public company I am currently running, has seen a 27% increase in occupancy since the assets were purchased in 2018, and anticipated end of year occupancy is 90%. (see attached)

We received NPS awards that were in the most excellent category, equivalent to Ritz Carlton, and almost double any other commercial real estate operator. Our tenants were happy with our performance and the majority of our tenants renewed with us. (see attached shareholder letter 4.1.25).

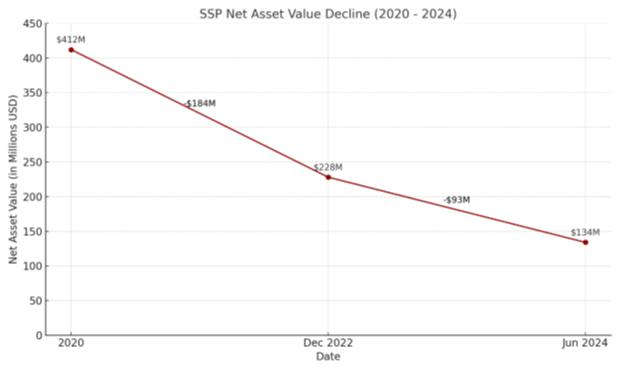

As shown below, the value of the Company dropped dramatically after I left. Haddock’s modus operandi was to fire all leasing agents and marketing people and allow the occupancy to drop dramatically. He also failed to maintain the properties as he cut the staffing overseeing property improvements from 6 people who had 50 years of experience collectively to 1 person who had no experience. The result was that the property conditions declined rapidly, the occupancy dropped, and negative cash flow developed on the properties. As a result, the properties were sold for fire sale prices. The company’s valuation spiraled out of control. There was no one on staff that had any experience in driving occupancy or in managing the properties.

As seen on the graph, Net Asset Value or “NAV” were completed on the dates noted. An integral part of valuing a company’s NAV is that you would include any commentary about property conditions. Nothing was ever mentioned in the NAV about deferred maintenance.

According to the Company’s own filings, the Company’s net asset value stood at $412 million in 2020. On April 13, 2023, SSP filed a Form 8-K indicating $228 million of net asset value for the period ending December 31, 2022, which resulted in the loss of an estimated $184 million in net asset value. On September 24, 2024, SSP filed a Form 8-K indicating further decline to $134 million of net asset value for the period ending June 30, 2024. This represented an additional $93 million destruction of net asset value over the 18-month period between January 1, 2023 and June 30, 2024. Now five months after their most recent NAV filing, Haddock and SSP colleagues are warning shareholders that a liquidation could yield zero value.

According to this filing, Haddock awarded himself 1 million shares of stock. His employment agreement calls for him to be awarded another 2 million shares of stock, under certain circumstances. This totals almost 5% of the company and about $6 million dollars in value. Fortunately, dilution of your interests through the award of additional shares to Haddock can be prevented by removing him from the board and terminating his employment agreement. Why would you reward somebody that has such a poor track record? When one destroys a company and simultaneously takes cash and stock from the company, he is violating a very basic fiduciary responsibility, and is creating liability for himself, the other board members, and the executive staff.

Haddock is further violating the law by not disclosing financial information about the Company that he is required to provide based upon a recent “Books and Records” request. (see attached)

He does not want you to see how he has spent $5M of your money fighting a shareholder meeting and how he is using the Company as his own personal piggy bank. Haddock’s latest ploy is spending your money to delay the shareholder meeting by requesting an emergency hearing with Judge Anthony Vittoria to reschedule the shareholder meeting.

The shareholder meeting is now scheduled for July 7th. I am by far the largest shareholder in the Company, and I am doing everything I can to preserve value and return capital to you as soon as possible. Thank you for your support.

Sincerely,

Al Hartman

Source:

https://www.sec.gov/Archives/edgar/data/831616/000110465925053519/tm2516360d1_dfan14a.htm

Member discussion