Carronade Capital (3.2% Stakeholder) Launches Proxy Fight at Cannae Holdings (CNNE), Citing Governance Failures and Value Destruction

Carronade Capital Files Definitive Proxy Statement for Cannae’s 2025 Annual Meeting

Cannae’s Reactive Actions Do Not Go Far Enough to Address Substantial Corporate Governance and Shareholder Accountability Failures

Asks Shareholders to Vote “FOR” Mona Aboelnaga, Benjamin Duster, Dennis Prieto and Cherie Schaible on Carronade’s GOLD Proxy Card

Launches Dedicated Shareholder Website ImproveCannae.com

DARIEN, Conn., October 28, 2025 – Carronade Capital Master, LP (together with its affiliates, “Carronade Capital”, “our” or “we”), which beneficially owns approximately 3.2 million shares of Common Stock of Cannae Holdings, Inc. (NYSE: CNNE) (“Cannae” or the “Company”) and is one of the Company’s top shareholders, today filed a definitive proxy statement in connection with its nomination of four independent and highly qualified candidates for election to the Cannae Board of Directors (the “Board”) at the Company’s upcoming 2025 Annual Meeting of Shareholders (the “2025 Annual Meeting”) and released a letter to Cannae shareholders.

Shareholders finally have an opportunity to have their voices heard and demand accountability after what we view as Cannae’s deliberate manipulation of the corporate machinery to deprive shareholders of their fundamental right to vote in a normal election cycle and a consequence of this Board’s decision to reincorporate from Delaware to Nevada. We believe the Cannae Board needs to be held accountable for its egregious governance practices, long history of affiliated party transactions, and poor performance – all of which underscore the urgent need for Board change and truly independent Directors.

The full text of the letter is below:

Dear Cannae Shareholders,

As a fellow investor in Cannae Holdings, Inc. (“Cannae” or the “Company”), we are reaching out to you to support meaningful change at Cannae with the goal of reinvigorating the Company and unlocking long-term shareholder value. Carronade Capital Master, LP (together with its affiliates, “Carronade Capital”, “our” or “we”), is one of Cannae’s largest shareholders, and we believe that improvements can be made that not only will significantly enhance shareholder returns but fulfill the promise made to shareholders. Our investment team has decades of experience identifying undervalued companies with potential for improved execution, collaborating with numerous boards and management teams, and unlocking opportunities to ultimately drive greater shareholder value.

Despite our numerous attempts to engage constructively with the Company since December 2024 and avoid a contested election, the actions of Cannae’s Board of Directors (“Board”) following our discussions have made it clear to us that they do not understand the urgency of the situation or believe change is necessary. For the first time, shareholders will be offered an alternative to the status quo.

We strongly believe Cannae:

· Continues to chronically underperform the market and its peers due to misguided corporate strategy;

· Bears the responsibility to return a substantial amount of shareholder capital on an accelerated and definitive timeframe while refraining from making additional private investments;

· Suffers from egregious corporate governance practices that impair investor confidence and performance; and

· Requires new, truly independent directors to push for much needed change, ensure accountability and provide a voice for outside shareholders in the boardroom.

For too long, shareholders have had to watch from the sidelines as Cannae’s Board and management have let the value of our shares erode while prioritizing their own compensation, amounting to hundreds of millions of dollars, over their fiduciary duties to shareholders. We have witnessed incremental progress with respect to capital return and minor improvements to governance, but continue to see major setbacks, including the extremely rare move of significantly delaying the 2025 Annual Meeting of Shareholders (the “2025 Annual Meeting”), and seeming to dismiss the potential for additional shareholder returns on the Q2 2025 earnings call. These actions and the resulting share price performance underscore shareholders’ dissatisfaction with the status quo which Carronade believes is unacceptable. Importantly, there is still significant work to be done, and we question whether any of these incremental changes would have occurred absent our involvement. The need for true independence to hold other directors and management accountable1 is further underscored by Cannae’s other seemingly reactive maneuvers following our involvement. This includes, but is not limited to, the egregious payouts to former CEO and Chairman Bill Foley for his “transition” to Vice Chairman which were approved by the Board after a -30% relative TSR performance during his tenure as CEO.

We are offering shareholders an alternative to business as usual to enact real change to reinvigorate a stagnant company that is disconnected from the value of its underlying assets. We are now actively seeking your support to elect four new independent and highly qualified nominees - Mona Aboelnaga, Benjamin Duster, Dennis Prieto and Cherie Schaible - to Cannae’s Board, who, if elected, are committed to working with their fellow directors to set a plan into motion that we believe could result in the Company’s equity having a share price upside of over 50% as a result of initiatives enacted in the next twelve months.2

As one of the top shareholders, we are significantly invested in Cannae and its future. We have a plan, which includes the election of our four director nominees who we believe are the best candidates to drive shareholder value creation.

1 Company 8-K filed on 05/12/2025.

2 Company filings, Bloomberg, Carronade analysis.

CANNAE’S ABYSMAL PERFORMANCE AND SHOCKING VALUE DESTRUCTION OVERSEEN BY THIS BOARD

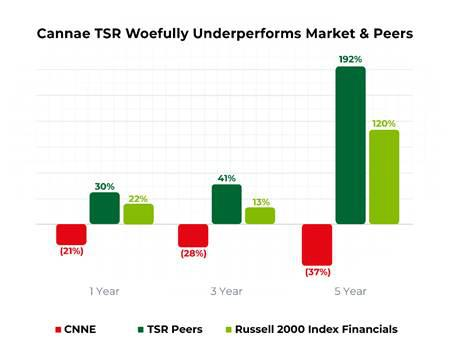

For years, Cannae shareholders have suffered as value eroded away. Amazingly, from its spin out in 2017 until our public letter in March 2025, Cannae had delivered a negative 5.2% total shareholder return despite being in one of the strongest bull markets in recent history3. Additionally, over the past three years, Cannae has traded at an average discount to its Net Asset Value (“NAV”) per share of -37%, and its current discount of -33% places it in the bottom two of over 200 US investment firms with assets over $500 million4. Cannae has also massively underperformed relative to its self-selected 2024 proxy peers and the Russell 2000 Index Financials. For the 1, 3 and 5 years preceding our public engagement, Cannae shares had returned –21%, -28% and –37% while TSR peers returned +30%, +41% and +192% and the Russell 2000 Index Financials returned +22%, +13% and +120%, respectively5. Since our public engagement in March 2025, Cannae shares have returned +9% while TSR peers and the Russell 2000 Index Financials have returned -4% and +6%, respectively.6

For a company that touts itself as “help[ing] maximize the value of those businesses for our shareholders”, Cannae has done a poor job of maximizing value.7 Recent public investments are worth less than Cannae’s cost of invested capital, and while the Dun & Bradstreet sale is a step in the right direction, not all of the proceeds are being returned to Cannae’s long-suffering shareholders.8

3 Bloomberg, Dow Jones US Total Stock Market Index.

4 Company published NAV reports on its website and Bloomberg. NAV as of 9/30/2025, discount calculated as of 10/17/2025.

5 TSR per Bloomberg as of 3/19/2025. Average cumulative shareholder return. 2024 10-K TSR Peers include MAIN, CODI, STEP, HTGC, FHI, CSWC, APAM, TRIN, HLNE, BRDG, GCMG.

6 TSR per Bloomberg as of 10/17/2025.

7 Quote sourced from Cannaeholdings.com homepage.

8 Cannae press release from 8/26/25 “Cannae Holdings, Inc. Notes Closing of Dun & Bradstreet Sale and $630 Million in Proceeds”.

In the Company’s most recent “Sum of the Parts” table, Cannae openly admits that its share price on September 30th, 2025, of $18.31, is a massive 33% discount to the NAV per share of the entire portfolio.9 It is unfathomable to us that a company with strong private assets, which include Premier League team AFC Bournemouth, French soccer team FC Lorient and The Watkins Company, is trading at this wide of a discount. We believe this persistent and significant discount is evidence that shareholders are tired of management siphoning hundreds of millions of dollars out of the business while performance flounders and that the Board has lost its credibility to hold management accountable, both of which underscore the need for new, independent directors to champion for change and reverse years of underperformance.

CANNAE’S HASTY INITIATIVES IN THE FACE OF A PROXY CHALLENGE FALL SHORT

In an effort to preempt Carronade’s calls for change, Cannae recently announced a series of purported “strategic actions” to address the deep-rooted governance issues plaguing the Company. While some of these initiatives are a step in the right direction, we believe they fall woefully short of the meaningful changes required to restore investor confidence and unlock shareholder value, and, in fact, they assume more of the same. Further, we believe they were designed and implemented to distract from Cannae’s ongoing efforts to rebuff shareholder engagement. 10

In reality:

· Mr. Foley was awarded tens of millions of dollars under the guise of a transition to Vice Chairman, despite virtually no changes to his purview, and he jumped to the front of the line for capital returns priced at a significant premium to the market - a deal which is inaccessible to other shareholders;

· Cannae increased the size of its Board and handpicked two new directors during the midst of an election contest, which was conveniently done right after Mr. Folley triggered his golden parachute;

· Cannae’s newly appointed “independent” Chairman has spent decades working closely alongside Foley and we believe his appointment will only serve to further entrench the Board;

· Cannae’s offer to de-stagger the Board was only made after we pushed for that specific governance improvement, and having it phased in over 4 years continues to disenfranchise shareholders for at least that long;

· Cannae altered the terms of the director equity incentive awards to provide for immediate vesting if any directors were not re-elected by shareholders;

· Cannae has problematically doubled down on their commitment to private investments, enabling less transparency around their already opaque investment process and pipeline;

· Cannae’s commitment to return $500 million of the Dun & Bradstreet sale proceeds amounts to only a portion of the publicly invested capital that can and should be returned to shareholders and lacks the speed and certainty required to establish confidence; and

· As a result, the market continues to place a substantial discount on Cannae’s NAV.

TRUE INDEPENDENT DIRECTORS NEED TO BE ADDED TO HELP FIX AN INTERTWINED BOARD

A board of directors has a fiduciary duty to act in the best interests of the company and its shareholders. However, when the board is completely intertwined with the founder it is virtually impossible for that board to be objective and independent. The board’s judgment becomes clouded, and choices that are supposed to be made for shareholders are choices made for the betterment of themselves and the founder. We believe this has become the case at Cannae – with Mr. Foley (Founder, Former CEO and Vice Chairman) exerting his influence over a very conflicted Board, resulting in gross underperformance.

9 Cannae Sum of the Parts table as of 9/30/2025.

10 Company announcements and disclosures in March and May 2025 8-K filings.

Almost all of the Cannae directors, including multiple supposed independent directors, have been affiliated with one or more entities controlled by Mr. Foley, including his personal company Black Knight Sports and Entertainment LLC.11 In our view, this has ultimately enabled Cannae to be run as Mr. Foley’s personal investment vehicle, with little to no accountability from the Board to public shareholders. Without the necessary independence, Cannae has faltered while Mr. Foley has personally cashed in. Since 2017 under this Board’s watch, Mr. Foley, his affiliated external manager12, and management have been paid a staggering $650 million13 while shareholders have earned less than 1% annually. Included in that total is nearly $17 million14 in lump sum payments paid to Mr. Foley associated with his “transition” to Vice Chairman despite Cannae TSR lagging peers by -30% during the 15 months Mr. Foley was acting CEO. Additionally, at a time when Cannae’s stock price was less than $17, the Board deemed it appropriate to grant Mr. Foley a right that requires the Company to purchase 50% of his shares at the greater of $19.50 per share or a 20% premium to the market. At the same time, the Board granted themselves immediate accelerated vesting of all outstanding Director equity awards if any incumbent Director is not re-elected to the Board by shareholders.

Fresh, independent perspectives are needed, and we believe Carronade’s four candidates possess the specific expertise and know-how and, most importantly, the independence to pursue achievable value creative initiatives:

· Mona Aboelnaga currently serves as Managing Partner of K6 Investments LLC and has over 35 years of investment management and private equity experience, including at Siguler Guff & Company and Proctor Investment Managers. She has served as a board member of both public and private companies, including Webster Financial, Perpetual Limited and Sterling Bancorp.

· Benjamin Duster is the Chief Executive Officer of Cormorant IV Corporation LLC and Mobile Technologies Inc. and has over 45 years of expertise with companies to improve execution effectiveness and create long-term sustainable value. He has served as a board member of both public and private companies, including Expand Energy, Weatherford International, Republic First Bancorp and Alaska Communications Systems.

· Dennis Prieto currently serves as Chief Restructuring Officer of Last Step Recycling LLC and Managing Partner at Peak Advisory Group. He has over 16 years of experience in complex financial analysis and operational restructurings and has served as a board member of Aventiv Technologies, Mohawk Gaming Enterprises and Endo International.

· Cherie Schaible is the founder of CLS Advisory, LLC and has served on a part-time basis as the general counsel of Thrasio. She previously served as General Counsel of Ankura Consulting Group and Associate General Counsel of AIG Investments. She has significant expertise in complex legal and financial matters and currently serves as a board member of Her Justice.

CARRONADE’S PLAN TO UNLOCK SHAREHOLDER VALUE

Along with our four seasoned and highly knowledgeable nominees, Carronade has several value creation initiatives that it believes could restore shareholder confidence and unlock substantial value for shareholders.

11 Company proxy statements, including its 2024 and 2025 proxy statements.

12 Until recently, Trasimene Capital Management served as Canne’s external manager.

13 Company Proxy Statements and form 10-K and 10-Q for years 2017 through 2025. Includes Management Fee and Management Incentive Payments (“MIP”) paid to Trasimene, Investment Success Incentive Payments (“ISIP”) paid directly to management, Stock Based Compensation and Cash Compensation for Named Executive Officers and MSA Termination Fees.

14 Lump sum payments of 300% of salary plus highest bonus of last three years.

· Return Capital and Unlock Value of Private Assets – We believe the Company needs to commit to a certain and timely return of meaningfully more capital to shareholders through spin outs or substantial buybacks from its remaining public assets, and thereafter provide a clear and consistent investment strategy which would lead to the restoration of its credibility. We believe these moves would significantly narrow the NAV discount and result in a re-rating of the Company’s remaining private portfolio. Without the public assets, management and the Board could focus on improving disclosure and valuation of the remaining private assets.

· Reduce Costs and Align Incentives – As part of streamlining the portfolio, we believe Cannae should implement a corporate overhead cost reduction program that reflects a best-in-class approach including performance-based incentive compensation for management. We also believe Cannae should have converted the Trasimene Capital Management termination fee into performance-based, vesting stock compensation.

· Add Independent, Shareholder-Friendly Voices to the Board – We believe the addition of Carronade’s four highly qualified director nominees to Cannae’s Board will bring the true independence that is sorely needed in the boardroom to represent shareholders, ensure accountability and enact much needed change. If elected, our nominees are prepared to immediately work with Cannae’s other directors to identify and execute upon opportunities for value creation.

· Enhance Governance – We believe additional governance improvements are required at Cannae. The Board should refresh the leadership of the Related Person Transaction Committee and reconstitute the Nomination and Governance Committee with truly independent and experienced directors, including the directors outlined above, if successfully elected. The Board should also create a new Strategic Review committee tasked with the formulation and oversight of successful execution of a plan designed to improve shareholder returns.

VOTE GOLD TO HELP RESTORE VALUE

No matter how many shares of Cannae common stock you own, we urge you to vote “FOR” Mona Aboelnaga, Benjamin Duster, Dennis Prieto and Cherie Schaible and DO NOT vote for incumbent directors, Erika Meinhardt, Barry Moullet, James Stallings, Jr. and Frank Willey, on the enclosed GOLD proxy card.

We are also asking shareholders to vote “AGAINST” Cannae’s proposal on executive compensation as we do not believe it is in the best interest of Cannae shareholders to approve the egregious compensation paid to the Company’s named executive officers.

Additional information on Carronade’s nominees can be found at ImproveCannae.com.

Sincerely,

CARRONADE CAPITAL MASTER, LP

Source:

https://www.sec.gov/Archives/edgar/data/1704720/000092189525002818/dfan14a14229002_10282025.htm

Member discussion