Deep Track Capital (14.5%) Pushes for Board Change at Dynavax (NASDAQ: DVAX), Slams Acquisition Focus and Urges Heplisav-Centric Strategy

Dear Fellow Dynavax Shareholders,

Deep Track Capital, LP (together with its affiliates, “Deep Track” or “we”) is one of the largest shareholders of Dynavax Technologies Corporation (“Dynavax”, “DVAX” or the “Company”), with ownership of approximately 14.53% of the Company’s outstanding shares. We manage approximately $4 billion on behalf of our investors – including many healthcare organizations and non-profits – and focus exclusively on the life sciences space and the development of novel therapies. Senior members of our team first purchased Dynavax shares nearly 15 years ago1 and we have continued to steadily build our position in the Company.

We have high conviction in Dynavax’s long-term potential. The Company’s lead asset, Heplisav, is extremely valuable and is poised for many years of growth and cash generation. In fact, we believe that Heplisav’s value creation potential will only improve as it becomes further established in the marketplace and becomes the standard of care for hepatitis B vaccination in adults.

Unfortunately, we believe that Dynavax is on the wrong track. Instead of focusing on growing Heplisav’s market position, the Company has pursued a years-long search for external assets to acquire. We tried to engage with the Company privately for many months to urge the Board to abandon its fruitless search for acquisition targets, return cash to shareholders through a share repurchase program, and focus exclusively on growing Heplisav – but were rebuffed.

We are not a typical “activist” investor. We are a long-term shareholder that is deeply concerned that the Dynavax Board is leading the Company down a path of value destruction that will have negative consequences for all stakeholders. That is why we have taken the extraordinary step (for us) of publicly airing our concerns and nominating four director candidates for the Company’s nine-member Board.

1Press Release, Dynavax Raises $44 Million Through Public Offering of Common Stock and Warrants.

Your vote at the Annual Meeting is important – now is the time to make your voice heard and help refocus Dynavax. As you consider your vote, please keep in mind the following:

The Board’s Misguided Strategy is Preventing Shareholders and All Stakeholders from Realizing Heplisav’s Full Potential

The Board, under the direction of Chairman Scott Myers, has for years pressured management to deploy cash on “empire building” acquisitions – and Dynavax has nothing to show for this strategy.

Specifically, in 2023, the Board tasked management with presenting an evaluation of at least three late stage/commercial opportunities. The Company’s subsequent focus on asset acquisitions and growing inorganically has yielded no viable opportunities and has distracted management from growing Heplisav – yet the percentage of management compensation tied to sourcing external opportunities has tripled from 5% to 15% over the past four years.

Management and the Board should be focused on realizing the opportunities offered by Heplisav instead of being distracted by sourcing external opportunities. We believe this is a key contributor to the flattening of Heplisav’s market share growth in recent quarters. Specifically, fourth quarter 2024 Heplisav market share reported by Dynavax was 44%, which is only slightly up from 42% in the prior year quarter. This is a critical period in Heplisav’s growth curve, and investors need Dynavax to be fully focused on the task at hand.

Recent missteps at Dynavax only highlight the significant risk and complexity of developing vaccines. In May 2024, the FDA rejected2 a long-standing effort to add the adult hemodialysis population to the Heplisav label, and in November 2024, Dynavax announced it discontinued development of Tdap-10183, which was designed to further leverage the Company’s proprietary adjuvant. Given this track record, we believe investors have little confidence that the Company would be able to acquire, successfully develop, and achieve licensure of an external asset on any sort of reasonable timeframe.

If management were “all-in” on Heplisav, we believe that it would provide many years of growth and margin improvement, and we estimate Heplisav would generate more than $1 billion of cash through 2030.

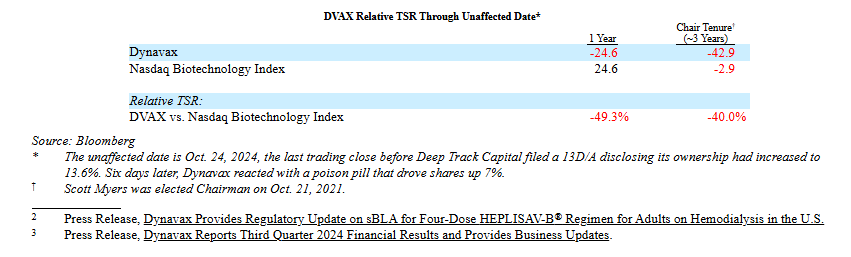

The Current Board’s Unfocused Strategy Has Destroyed Shareholder Value

Dynavax has delivered negative total shareholder returns (“TSR”) in recent years despite Heplisav sales growing more than fourfold from 2021 to 2024, including over 25% last year. See the chart below.

We believe the Company’s underperformance demonstrates a lack of investor confidence in its current strategy and concerns that Dynavax is going to squander its profits on a misguided acquisition.

Shareholder-Driven Change is Urgently Needed to Avoid Value Destructive Blunders

The Company has been a poor steward of shareholders’ capital – and new voices are needed in the boardroom to reverse this trend. For example, Dynavax recently refinanced the majority of its outstanding convertible debt with expensive new convertible notes rather than pay down its debt obligations using some of its ~$714 million cash on hand. It is inexplicable, in our view, that the Board thought this was a better use of cash than returning incremental value to shareholders.

The Board has taken positive steps only reactively in response to our public pressure. In our view, this shows that the incumbent directors cannot be trusted to truly represent the best interests of all shareholders. For example, the Board announced a reactive $200 million share buyback just two weeks after our amended 13D filing, despite us having urged the Company privately for months to return capital to shareholders. The Company subsequently announced the replacement of two directors. Adding two directors hand-picked by an entrenched Board does not, unfortunately, do anything to assuage investors’ concerns about a lack of independence – especially given that one of these individuals previously served on another board with Mr. Myers. The Board’s endemic entrenchment is further evidenced by its proposal to de-stagger over the course of three years, rather than having every director up for re-election this year.

We have tried to reach a settlement and have demonstrated a willingness to compromise, yet the Board has not made any effort to adjust its position. Most recently, we offered to settle by adding two of our candidates to replace two long-tenured directors and to give up our ability to nominate director candidates at the 2026 Annual Meeting. Given our settlement offers, we believe it is ludicrous for the Company to argue we are seeking control of the Board.

We Urge Shareholders to Elect Our Four Highly Qualified Nominees

A refreshed Board could drive critical improvements to the Company’s strategy and ensure it is on the best path forward for all stakeholders – including by eventually eliminating hepatitis B – while maximizing the long-term value of the Company’s assets.

Our nominees are not tied to prior Board decisions and would critically evaluate the Company’s strategy. They would also bring financial, healthcare-related, and corporate governance experience and expertise, as well as fresh thinking and shareholder alignment. A shareholder representative is desperately needed, in our view, so that investors can feel confident about the Company’s direction.

We are not trying to gain control of the Board, as Dynavax has falsely alleged. We are seeking to elect four nominees to a nine-member Board; three of our four nominees are independent of Deep Track.

We urge you to vote FOR our highly qualified nominees:

Brett Erkman: a Managing Director at Deep Track Capital. Mr. Erkman has spent the last twenty years investing in biotechnology companies and will bring a much needed (and the only) perspective of a large shareholder to the Board.

Jeffrey Farrow: the Chief Financial Officer at Tarsus Pharmaceuticals (NASDAQ: TARS). Mr. Farrow was also the CFO at Global Blood Therapeutics, Inc. (formerly NASDAQ: GBT; sold to Pfizer for $5.4 billion), ZS Pharma, Inc. (formerly NASDAQ: ZSPH; sold to AstraZeneca for $2.7 billion), and Hyperion Therapeutics (formerly NASDAQ: HPTX; sold to Horizon Pharma plc for $1.1 billion).

Michael Mullette: the interim Chief Executive Officer at Lykos Therapeutics. Mr. Mullette was previously the Vice President of North American Commercial Operations at Moderna, Inc.

(NASDAQ: MRNA) and spent nearly twenty years at Sanofi (NASDAQ: SNY) in a variety of positions including senior roles in global commercial operations.

Donald Santel: the former President and Chief Executive Officer of Hyperion Therapeutics (formerly NASDAQ: HPTX), which developed and brought Ravicti to market for urea cycle disorders and was ultimately acquired by Horizon Pharma in 2015. Prior to Hyperion, Mr. Santel was the Chief Executive Officer of CoTherix (formerly NASDAQ: CTRX), which developed Ventavis for pulmonary arterial hypertension and was acquired by Actelion in 2006.

This year’s Annual Meeting offers an important chance to make your voice heard. Do not let the Dynavax Board continue to ignore your best interests.

Regards,

David Kroin

Founder and Chief Investment Officer, Deep Track Capital LP

Source:

https://www.sec.gov/Archives/edgar/data/1029142/000119312525087436/d947952ddfan14a.htm

Member discussion