Findell Capital Targets Oportun Financial (OPRT) Governance, Seeks Board Seat to End CEO Control and Refocus Strategy

Fellow Oportun Stockholders:

We are the largest stockholder of Oportun Financial Corporation (“Oportun” or the “Company”), with an approximately 9.5% equity stake in the Company. Over the last two years, we have repeatedly urged Oportun’s Board of Directors (the “Board”) to act as an honest fiduciary rather than as a captive enabler of CEO Raul Vazquez. Our efforts resulted in the addition to the Board in 2024 of independent directors Scott Parker and Richard Tambor, who each possess valuable experience in direct lending and whose appointments resulted in significant improvements in credit and cost reductions.

However, we believe Oportun today remains hamstrung by legacy directors and executives who continue to delay further operational and governance enhancements that would create meaningful value for stockholders. We have concluded that additional change to the composition of the Board is needed to ensure the Board’s independence from management and to realize the full potential of Oportun.

To that end, we have nominated Warren Wilcox, an independent and highly qualified director candidate, for election to the Board at the 2025 Annual Meeting of Stockholders (the “Annual Meeting”). Mr. Wilcox is a seasoned lender whose election will end the legacy directors’ majority control of the Board and enable the Board to provide effective long-term oversight of the business.

We will soon be mailing you a proxy statement and a WHITE universal proxy card where you will have an opportunity to vote on the future of the Company. In the meantime, you may find additional information on our newly launched campaign website: www.OpportunityAtOportun.com

The Legacy Board Has Failed to Turn Around Oportun’s Underperformance & Effectively Oversee CEO Vazquez

In our view, Mr. Vazquez has destroyed a great lending business by ballooning Oportun’s cost structure and net charge offs while attempting to turn the Company into a fintech conglomerate and a personal empire. We believe Mr. Vazquez’s mistakes should have been arrested at the Board level – something the Board has evidently been incapable of or unwilling to do. In fact, the Board has apparently only encouraged Mr. Vazquez, most recently by appointing him Chief Financial Officer and principal accounting officer in addition to his role as CEO, despite his lack of accounting experience. This ineffective oversight is unsurprising in light of the facts that not a single legacy director has lending experience, and that many legacy directors have close personal and professional ties to Mr. Vazquez.

Our calls for Oportun to reverse Mr. Vazquez’s empire-building efforts and refocus on its core lending business eventually forced a course correction, which was further aided by the addition of Messrs. Parker and Tambor in 2024. However, the changes have come slowly – and stockholders have had to suffer a 40% dilution¹ since our engagement began in order to cover the Company’s strategic blunders.

¹ Oportun’s weighted average common shares outstanding reported as of Q1 2023 was approximately 34 million; by Q4 2024, that figure had ballooned to 43.5 million, plus an additional 4.8 million shares issuable on conversion of warrants recently issued by the Company.

While the Company has made slow progress, Oportun is still substantially underperforming as evidenced by its operating results and by the subpar performance targets that have been set by the Board, which suggest that there is no sense of urgency in fixing the business. We believe that Oportun will not move forward so long as it maintains a staggered 10-person Board that is controlled by six long-tenured legacy directors who comprise the entirety of its committee and Board leadership.

The Company’s operational and strategic performance under the supervision of the legacy directors clearly demonstrates the need for change:

While competitors like OneMain Holdings, Inc. (“OMF”) kept their operating expenses (“opex”) per loan and corporate head count flat from 2019 to 2023, Oportun grew its aggressively by 109% and 70%.²

Unnecessary acquisitions caused the Company to deviate from its core lending mission and generated substantial losses – for instance, the Company wasted $211 million on the value-destructive acquisition of Hello Digit, Inc. in 2021, or 12x its book value.³

These problems arose, we believe, from serious flaws in the Company’s governance structure, which seems designed to negate accountability and facilitate management’s value-destructive behavior:

Despite its small market capitalization (<$200 million), Oportun is overseen by a bloated 10-person staggered Board with only four directors who appear independent from management.

Many of the legacy directors have worked with each other and with Mr. Vazquez in prior professional roles, forcing us to question the degree of independent oversight actually being exercised.⁴

Not one of the six legacy Board members has lending experience.

When we urged the Board to shrink from 10 directors to eight, the Board refused.

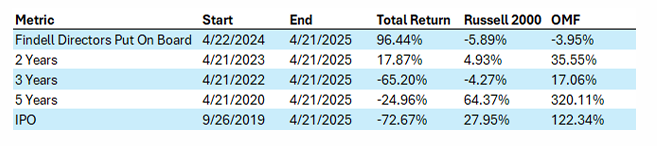

Since the appointment of Messrs. Parker and Tambor in 2024 as part of our cooperation agreement with the Company, Oportun’s total return has meaningfully improved, demonstrating the importance of proper Board oversight.⁵

² OMF filings; Company filings.

³ https://investor.oportun.com/news-events/press-releases/detail/25/oportun-completes-acquisition-of-digit-a-neobanking

⁴ As we described in a previous letter: https://www.prnewswire.com/news-releases/findell-capital-management-issues-open-letter-to-board-and-shareholders-of-oportun-nasdaq-oprt-calling-for-leadership-change-302406810.html

⁵ Data sourced from Bloomberg.

It’s important to highlight that we endeavored to avoid a proxy fight this year by seeking to collaborate with Oportun on a plan that would place directors with lending experience in Board leadership positions. Unsurprisingly, the legacy directors refused our offers, further demonstrating that they are more focused on retaining their positions and keeping the current management team in place instead of driving stockholder returns.

In March of this year, we offered two experienced and independent director candidates to the Company whose addition to the Board would, we believed, provide it with significant lending expertise and promote good governance. Now that it has become apparent to us that no collaborative solution is possible, we have withdrawn one of our recommended candidates and are focusing our efforts on electing industry veteran Mr. Wilcox at the Annual Meeting to end the legacy directors’ control over the Board.

This Year’s Election Contest Represents an Opportunity to Establish an Independent Board Led by Independent Lending Industry Veterans

With the election of Mr. Wilcox at this year’s Annual Meeting, stockholders can once and for all ensure that the entrenched legacy members no longer control the Board. Mr. Wilcox’s addition to the Board will ensure that the Board is led by independent directors with lending industry experience and a level of objectivity that will enable them to effectively oversee management.

We also urge Oportun to take the following actions, which we believe will result in sustainable value creation for stockholders:

Further reduce costs so that the Company’s opex ratio, which currently stands at 15%, targets 10% and is more in line with best-in-class operator OMF at less than 7%.

Remove the self-imposed interest rate cap of 36% so that Oportun can better serve its customer base.

De-stagger the Board and ensure it is fully independent with no professional or personal ties to management.

Appoint current directors with lending experience (Mr. Parker, Mr. Tambor and Carlos Minetti) to Board leadership roles.

We believe that much better days lie ahead for Oportun once stockholders wrest control of the Company from its irresponsible legacy directors and imperial CEO. In the coming weeks, we look forward to sharing additional information regarding the qualifications of Mr. Wilcox and our plan to unlock Oportun’s full potential.

Sincerely,

Brian Finn

CIO

Findell Capital

Source:

https://www.sec.gov/Archives/edgar/data/1538716/000092189525001314/ex991to13da813982002_050725.pdf

Member discussion