Hartman Group Urges Silver Star Properties (SLVS) Shareholders to Reject “Failed” New Direction Plan, Pushes for Liquidation and Capital Return Amid Sharp NAV Decline

June 4, 2025

Dear Silver Star Properties, Inc. Shareholder,

As SSP shareholders we are concerned about and frustrated with the level of destruction to net asset value attributable to shareholders over the past thirty-three months under the leadership of Mr. Haddock and his SSP colleagues. In sum, SSP’s net asset value attributable to shareholders has declined from $228 million on December 31, 2022 to an estimated $20.6 million as of March 2025 (per SSP’s Spring 2025 presentation). Since my separation from SSP, the level of value destruction perpetrated by Mr. Haddock and his SSP colleagues is unacceptable – especially when you consider the excessive executive compensation, unearned share awards and profits interest. Despite their bogus claims of deferred maintenance issues, as noted herein the value destruction relates to (i) their failed operational and financial management of SSP since my forced departure and (ii) the ill-conceived, poorly executed and failed New Direction Plan.

After awarding himself 1,000,000 SSP shares (at no cost with no vesting) for destroying SSP’s net asset value, Mr. Haddock now claims to have the same economic interests as shareholders - who invested their hard-earned money in SSP. The 1,000,000 SSP share award is on top of the outsized executive compensation and outrageous profits interest the Executive Committee awarded themselves. Of course, Mr. Haddock and his SSP colleagues now claim the profits interest have no current value while failing to disclose the tax considerations from the award. What arrogance and hubris!

As well, Mr. Haddock and his SSP colleagues have selectively released very limited operating information as part of their relentless smear of me and my performance. They have distorted the limited information in an attempt to hide their incompetence and malfeasance. Despite receiving a valid books and records request to release complete financial information (to which SSP shareholders are entitled under Maryland law - without exception) Mr. Haddock and his SSP colleagues have engaged in stonewalling, revisionist history and deflection. Mr. Haddock and his SSP colleagues’ lack of transparency reflects disdain and a lack of respect for SSP shareholders.

SSP shareholders have a stark choice. One option is to not vote or vote in support of SSP nominated directors Haddock, Tompkins and Still and their ill-conceived, poorly executed and failed New Direction Plan. The other option is vote in support of Longnecker, Thomas and me - the directors I have nominated. Longnecker, Thomas and I have proven experience managing real estate, making distributions and performing through various business cycles. We will restore shareholder value, monetize assets and return capital to SSP shareholders. Please vote and make sure your voice is heard.

SSP shareholders are also faced with a crucial choice, to vote to reject the New Direction Plan. We believe that it is in the shareholders best interest to vote for our proposal to liquidate the Company’s assets and return capital to stockholders, and against an alternative strategy and pivot into self-storage.

As you reflect on your decision allow me to correct several mis-statements in recent SSP communications. The “burn the house down” statement never occurred. It is complete fiction. Mr. Haddock is desperate. He has proven he will say anything. Jay Quine a XXI board member was on the call with the DOL investigator. We both took extensive notes. Nothing remotely proximate to the alleged statement was made by Mr. Quine or me. As well, I did not attempt to “strong arm” SSP or members of SSP’s board of directors. It is also complete fiction. Again, more contrived hyperbole and deflection from Mr. Haddock and his SSP colleagues to hide their incompetence and malfeasance.

Instead of defending their poor performance, Mr. Haddock and his SSP colleagues mock me and my performance. Their conduct evidences a lack of professionalism and failure to take more seriously the damage they have caused SSP shareholders. If Mr. Haddock and his SSP colleagues were really interested in aligning with SSP shareholders, they would have invested their personal funds in SSP shares. Instead, they have helped themselves at the trough by awarding themselves outsized compensation, unearned share awards (at no cost with no vesting) and the outrageous profits interest – all at SSP shareholders’ expense.

Their actions clearly evidence they are entrenched and not interested in protecting SSP shareholders. Their failure to release complete information as required under Maryland law and historical occupancy levels since my forced departure while relentlessly trafficking in smears of my character and my performance is self-evident. Mr. Haddock and his SSP colleagues lack of transparency is clear evidence they are entrenched and attempting to hide their incompetence and malfeasance while working against the interests of SSP shareholders who have invested their hard-earned money.

Hartman’s Monetization and Return of Capital to SSP Shareholders Plan

SSP shareholders indicate they prefer immediate liquidity and a return of capital over the unacceptable performance of Mr. Haddock and his SSP colleagues and the ill-conceived, poorly executed and failed New Direction Plan. I am fully aligned with the liquidity and return of capital objectives of the SSP shareholders who have contacted me. This communication is in furtherance of my efforts to restore shareholder value and provide a sensible path forward including providing financial transparency for SSP shareholders.

My objective is to monetize the Walgreens leaseholder interests and storage assets. I am actively evaluating a number of options which would promptly return capital to SSP shareholders. The legacy assets will be managed and leased to maximize their value. To be clear, my objective is achieving shareholder liquidity at the highest price. This is not a “burn the house down” strategy. It is not a “strong arm” tactic either.

My track record includes being named the #1 performer by Stanger in the non-traded REIT space. Under my leadership, investors received annual distributions ranging from 6% to 10%.

Investment Thesis

If SSP investors wanted to invest in storage or leasehold interests, there are any number of successful storage and leasehold investments with a lengthy, proven track record to choose from. Mr. Haddock and his SSP colleagues never offered SSP shareholders an alternative to his ill-conceived, poorly executed and failed New Direction Plan. Most SSP shareholders invested in SSP seeking office/multi-tenant retail/industrial-flex diversity. Engaging in substituted judgment with respect to shareholder funds is further evidence of their arrogance and hubris.

Sale of Legacy Assets

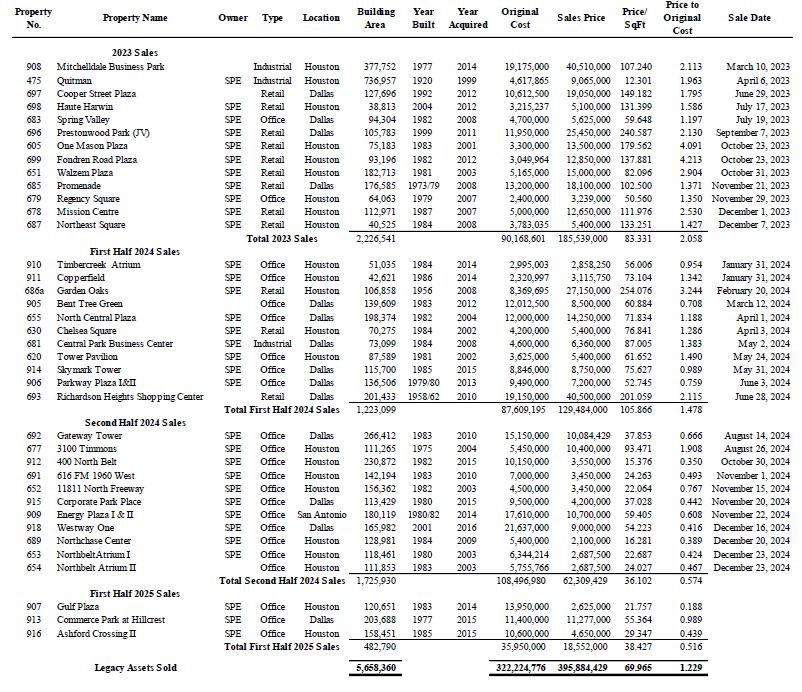

I developed the following table summarizing the sale of legacy assets, based on the limited information contained in SSP’s recent disclosures:

Original cost reflects the initial purchase cost. In the interim, mergers between XVI, XVII and XVIII and the subsequent XIX, XX and HI-REIT merger resulted in various accounting adjustments. Given the recent dismissive comments from SSP discounting the tenant and leasehold improvements, I have disregarded those adjustments. I have also not included any accounting impairments to be consistent with SSP’s disclosures. As of December 31, 2022, SSP and the SPE had an estimated $155 million in land and $285 million in building improvements, or a total of $440 million. Since December 31, 2022, SSP has sold $395.8 million of legacy assets. SSP retains an estimated $80.6 million of legacy assets.

Legacy asset sales in 2023 realized $83.33 per square foot and 2.058 times original cost. Legacy asset sales in the first half of 2024 realized $105.86 per square foot and 1.47 times original cost. Sales per square foot increased 27.04% in the first half of 2024. Legacy asset sales in the second half of 2024 realized $36.10 per square foot and 57.4% of original cost. Sales per square foot decreased 65.89% in the second half of 2024. Legacy asset sales in the first half of 2025 realized $38.42 per square foot and 51.6% of original cost. Sales per square foot increased 6.43% in the first half of 2025. This gradual consistent reduction of price per square foot sales price from $83 to $105 to $36 to $38 each 6-month period shows that they were not taking care of the properties and occupancy dropped and they had to fire sale the assets, especially in the last 12 months. These results directly refute and contradict Mr. Haddock and his SSP colleagues contrived argument regarding purported deferred maintenance.

I would also draw your attention to SSP disclosures and filings subsequent to my forced departure in October 2022. There was not a single disclosure by SSP about purported deferred maintenance. They concocted the purported deferred maintenance issue after my letters at the end of 2024 criticizing their performance and the January 2025 court ruling ordering the shareholder meeting by July 21, 2025. Their claims regarding deferred maintenance should also be considered against their lack of transparency and failure to provide a complete financial picture including occupancy levels in 2023, 2024 and 2025. Mr. Haddock and his SSP colleagues are simply trying to have it both ways – again at SSP shareholders’ expense.

The numbers are very clear, Mr. Haddock and his SSP colleagues had no plan to address occupancy levels after my forced departure. Occupancy was not a strategic imperative. They also failed to properly maintain legacy assets in their haste to pursue their ill-conceived, poorly executed and failed New Direction Plan. It was only after my letters drew attention to their failed performance, Mr. Haddock and his SSP colleagues contrived the bogus deferred maintenance claim while also intentionally withholding information from SSP shareholders - in violation of Maryland law. SSP shareholders deserve better!

It also deserves mention Tompkins has been a SSP board member since 2009. Haddock and Still have been SSP board members since 2020. As a non-publicly traded REIT, SSP’s board members’ primary responsibility is setting net asset value attributable to shareholders. Before I was forced out, SSP undertook a rigorous analysis of net asset value attributable to shareholders which was thoroughly vetted by board members. A reasonable interpretation of Mr. Haddock and his SSP colleagues’ bogus claims of purported deferred maintenance is SSP’s net asset values attributable to shareholders are not reliable. Again, the sale of legacy assets in 2023 and the first half of 2024 suggests otherwise. In truth, the real issue appears to be Mr. Haddock and his SSP colleagues’ ill-conceived, poorly executed and failed New Direction Plan including their failure to have an occupancy plan in place when I was forced out.

Keep the aforementioned in mind as you consider Mr. Haddock and his SSP colleagues are paying themselves over $1 million of executive compensation, Haddock shamefully awarded himself 1,000,000 shares (at no cost with no vesting) and they awarded themselves an outrageous profits interest – all at the expense of SSP shareholders. Enough already with the greed!

Allocation of Capital

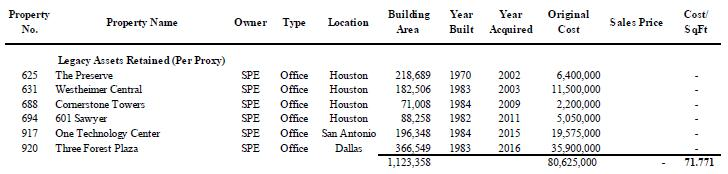

I have developed the following tables, based on the limited information contained in SSP’s recent disclosures:

The recent sales of Gulf Plaza, Commerce Park at Hillcrest and Ashford Crossing generated $18.5 million which was used to reduce the current debt balance to $100.6 million net of unamortized deferred financing costs.

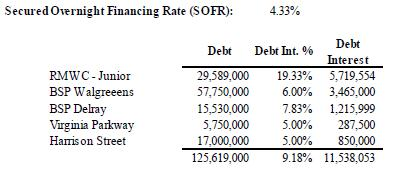

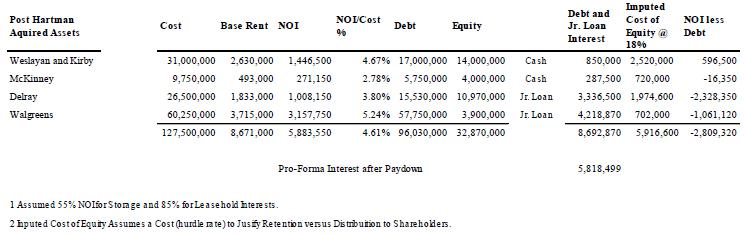

SSP’s proxy materials indicate Mr. Haddock and his SSP colleagues have sold $395.9 million of legacy assets and acquired $127.5 million of assets since my forced departure. The acquired assets have $8.6 million of base rent and an estimated $5.8 million of net operating income. The assets were acquired with $96 million of debt, $18.4 million of cash and $14.8 million of expensive junior debt (current annual rate of 19.33%).

The annual debt interest is $8.7 million before paydown of the RMWC junior debt (which was done with funds that should have been distributed). Assuming full paydown of the RMWC junior debt would mean $32.8 million of equity (which should have been distributed to SSP shareholders) has been invested in assets with expected annual net operating income of $5.8 million. On a pro-forma basis, the on-going annual interest cost will be $5.8 million and imputed cost of equity (which should have been distributed to SSP shareholders) is $5.9 million.

In other words, Mr. Haddock and his SSP colleagues have sold legacy assets with an estimated fair value of in excess of $550 million as of December 31, 2022 for $395.8 million. SSP retained an estimated $80.6 million of legacy assets. SSP used $32.8 million of SSP shareholder funds (which should have been distributed to SSP shareholders) to acquire assets which are expected to generate $5.8 million of annual net operating income while incurring an estimated $5.8 million in annual interest costs and an imputed cost of equity of $5.9 million. The numbers indicate the acquired assets do not service interest costs before factoring in the cost of equity. SSP should have distributed funds to SSP shareholders as opposed to investing in the Walgreen’s leasehold interests and storage assets that actually have a negative cash flow!

As well, Mr. Haddock and his SSP colleagues have failed to be transparent throughout this process. Now Mr. Haddock and his SSP colleagues are proposing a speculative and not well thought out $50 million preferred equity raise to further his vanity. SSP shareholders would be subordinate to the proposed preferred equity and dividends. I have repeatedly questioned Mr. Haddock’s over-leveraging of SSP’s balance sheet. Adding $50 million of preferred equity on top of the over $100 million of existing, expensive leverage - would be the real disaster. To be clear, the preferred equity raise is clear evidence Mr. Haddock and his SSP colleagues are not serious about returning shareholder capital to SSP shareholders.

Adding additional preferred dividends to “double-down” on the ill-conceived, poorly executed and failed New Direction Plan is not a reasonable alterative to returning capital to SSP shareholders.

CMBS Debt

The CMBS debt had a three-year term. I was forced out in October 2022 at the end of the second year. Mr. Haddock and his SSP colleagues had another year to resolve the renewal issue. Blaming me for their failure is simply more revisionist history and deflection. Given prevailing interest rates and market conditions in mid-2022, I submitted a plan to the SSP board of directors to sell selected assets and use the additional liquidity to refinance the CMBS debt. In June 2022, Mr. Haddock and his SSP colleagues rejected my plan.

The plan involved an extensive review of our real estate portfolio. It was an “all-hands, company-wide” effort. There were no material deferred maintenance issues. Despite SSP management’s dismissive comments, SSP’s public filings reflected $11.9 million of capital expenditures in 2022, $13.38 million in 2021 and $13.38 million in 2020. As well, occupancy levels were performing well. In fact, we were doing so well, we won the gold standard in tenant satisfaction award, Net Promoter Score, as the best commercial operator in the country in 2022. Net Promoter Score, NPS, is an integral measurement metric that proves under our leadership we had high tenant satisfaction, leading to a high retention rate, and no deferred maintenance.

Further, I made sure SSP had a fully staffed maintenance and repair department to address maintenance, repairs and tenant improvements. The capex spend noted above reflects my commitment to maintaining the property portfolio. It is my understanding, after my forced departure, Mr. Haddock and his SSP colleagues reduced the building engineering managers from six who had 50 years’ cumulative experience to a single individual who had no experience. They reduced the capex spend substantially. Their performance is clear evidence maintaining the legacy assets was not a priority. I can not be reasonably blamed for their failure after being forced out.

I would also note substantially all SSP’s current indebtedness matures in less than one year which is ironic given Mr. Haddock and his SSP colleagues’ comments about the CMBS debt in 2022.

IPO and 10 Year Life of SSP

Mr. Haddock is both badly misinformed and his comments are intentionally deceptive. Mr. Haddock fancies himself as a clever lawyer. Mr. Haddock and his SSP colleagues also fail to take responsibility for their failed performance with SSP’s net asset value attributable to shareholders – after I was forced out. It is clear, Mr. Haddock and his SSP colleagues had no occupancy plan when I was forced out as CEO. Occupancy was not a strategic imperative for Mr. Haddock and his SSP colleagues. Their subsequent public disclosures made no mention of occupancy or the purported deferred maintenance issues. Mr. Haddock and his SSP colleagues failure to take occupancy more seriously and their insistence on accepting any price for legacy assets as the ill-conceived and poorly executed New Direction Plan unveiled itself - cost SSP shareholders dearly.

The Ill-Conceived, Poorly Executed and Failed New Direction Plan

The following are my perspective and insights regarding Mr. Haddock and his SSP colleagues failed management and the ill-conceived, poorly executed and failed New Direction Plan:

§ I filed the Maryland lawsuit to force a shareholder meeting. I strongly believe SSP shareholders have the right to vote on the future direction of the company. Given their performance, Mr. Haddock and his SSP colleagues clearly do not deserve the benefit of the doubt on this important issue. Because of my efforts, SSP shareholders now have the opportunity to vote.

§ Despite their relentless legal maneuvers to deny shareholders the right to vote, I remained undeterred. Mr. Haddock and his SSP colleagues’ actions evidence they sought to deny shareholders the opportunity to vote because they know shareholders would opt to liquidate SSP and return shareholders’ capital, as opposed to further value destruction.

§ Examples of their profligate wasting of SSP resources can be found in a derivative lawsuit filed against SSP which details allegations of unconstrained spending including SSP’s Executive Committee issuing themselves over 3 million “profits interests” convertible to partnership units (which could be valued at $10-20 million and would be highly dilutive to SSP shareholders), (ii) the current co-CEO’s have been awarded annual compensation of $1 million, (iii) Haddock awarded himself 1,000,000 SSP shares (at no cost with no vesting). Given the poor net asset value performance, SSP’s leadership has not earned this level of executive compensation.

§ It is my understanding a large well-known compensation expert deemed SSP’s executive compensation excessive and declined SSP’s request to issue an opinion in support of their executive compensation.

§ SSP’s ill-conceived, poorly executed and failed New Direction Plan included an initial public offering. Their focus has now shifted to an expensive, speculative preferred equity raise which would “double-down” on the ill-conceived, poorly executed and failed New Direction Plan. SSP shareholders would be subordinate to the preferred shareholders and preferred dividends. SSP shareholders are subordinate to the profits interest Mr. Haddock and his SSP colleagues awarded themselves. This is further evidence of Mr. Haddock and his SSP colleagues have no intention of honoring SSP shareholders’ preference for a return of capital.

§ In light of the noted issues, providing SSP shareholders with immediate liquidity and returning shareholders’ capital is the appropriate, prudent and reasonable approach. Longnecker, Thomas and I – the Hartman nominated directors are all in alignment with SSP shareholders. We will restore shareholder value, monetize assets and return capital to SSP shareholders.

Mr. Haddock and his SSP Colleagues Lack of Financial Transparency

The following are my opinions regarding SSP’s lack of financial transparency, including Mr. Haddock’s statements:

§ Mr. Haddock’s and SSP’s ill-conceived, poorly executed and failed New Direction Plan has been a complete failure. SSP’s net asset value attributable to shareholders has declined from $228 million on December 31, 2022 to an estimated $20.6 million as of March 2025 (per SSP’s Spring 2025 presentation).

§ Mr. Haddock and his SSP colleagues have failed to provide a reasonable accounting of their actual operating and property management performance including occupancy performance and capex for 2023, 2024 and 2025

§ Instead, SSP shareholders are left to decipher opaque, misleading and contradictory public statements and filings while Mr. Haddock and his SSP colleagues relentlessly traffic in a personal smear against me and my performance. This is a flagrant misuse of SSP resources against a major SSP shareholder. Their avarice must be stopped!

§ Specifically, Mr. Haddock and his SSP colleagues failed to properly manage SSP’s operating expenses while SSP’s management intensive legacy assets were sold off. We believe SSP has reduced staff to 23 as of March 31, 2025, however, SSP incurred unnecessary, undisclosed and significant losses from operations in 2023 and 2024 - contributing to the deterioration of SSP’s net asset value attributable to shareholders. The reflects Mr. Haddock and his SSP colleagues lack of real estate operating experience and financial discipline.

§ As well, Mr. Haddock and his SSP colleagues have failed to properly manage SSP’s legacy assets, leading to declining occupancy levels and resulting in below market sales prices in the second half of 2024 and first half of 2025. This failure has resulted in unnecessary and unreasonable losses from legacy asset sales - contributing to the deterioration of SSP’s net asset value attributable to shareholders.

§ While Mr. Haddock and his SSP colleagues seek to blame me for the decline in SSP’s value, keep in mind SSP recognized a $26.117 million “gain on sale of assets” for the three months ending March 31, 2023. It also appears property sales in 2023 and the first half of 2024 resulted in reasonably attractive prices and did not reflect significant deferred maintenance.

§ The property sales completed in 2023 and the first half of 2024 are the best evidence of my performance, management and leadership at SSP. In 2023, SSP sold 2.22 million square feet of legacy assets for $185.5 million, or $83.33 per square foot. In the first half of 2024, SSP sold 1.22 million square feet of legacy assets for $129.4 million, or $106.86 per square foot. The aforementioned argues against the false deferred maintenance claims being asserted by Mr. Haddock and his SSP colleagues – while also denying SSP shareholders information in direct violation of Maryland law.

§ I cannot reasonably be blamed for declining sales results in the second half of 2024 and first half of 2025 which resulted from Mr. Haddock and his SSP colleagues’ failure to properly manage SSP’s legacy assets or the resulting decline in occupancy levels after I was forced out in October 2022.

§ Mr. Haddock and his SSP colleagues’ rationale and judgment in liquidating SSP legacy assets regardless of price should be further examined. As examples, the sale of Westway for $9.0 million, sale of Northchase for $2.15 million, sale of Atrium I and Atrium II for $5.375 million and sale of Ashford Crossing for $4.65 million need to be compared to the estimated asset values of the properties on or about my separation from SSP including $16 to $23 million for Westway, $5 to $8 million for Northchase, $11 to $15 million for Atrium I and Atrium II and $11 million for Ashford Crossing.

§ My analysis indicates the resulting deterioration of value in the aforementioned properties after my separation is directly related to Mr. Haddock and his SSP colleagues’ failure to properly manage SSP’s legacy assets. Further, their haste to accept any price can reasonably be taken as an effort to disguise their failure to properly manage SSP’s legacy assets. It has been my experience sophisticated buyers understand how to fully leverage motivated sellers.

§ To further amplify this issue, Gulf Interstate occupancy declined from about 90% to 15%. One Technology Center occupancy declined from 90% to 45%. SSP hired a firm to lease One Technology Center. Apparently, the firm engaged by SSP diverted One Technology Center’s largest tenant. In my view, this is a clear indication Mr. Haddock and his SSP colleagues’ failure to properly manage SSP’s legacy assets and allowing occupancy levels to decline under their leadership.

§ Another example of their failure to properly manage SSP’s legacy assets is the Preserve. The property is well located and has historically maintained strong occupancy levels. It is my understanding leasing agents submitting potential tenants for the Preserve often do not get their calls returned by SSP. As well, after my forced departure, tenants often complain of the lack of security, cleanliness and failure to address maintenance issues. Again, in my view, these issues are a clear indication Mr. Haddock and his SSP colleagues’ failure to properly manage SSP’s legacy assets and allowing occupancy levels to decline under their leadership.

§ Walgreens in the midst of a major cost reduction plan including a major store closure program. Walgreen’s leases usually have high initial rental rates without any rental increases over the term of the lease which usually include cancelation options at the election of the tenant. Thus, the stated cap rates appear overly aggressive in light of the risk-free rates available in the market.

§ Mr. Haddock and his SSP colleagues have consistently promoted the purported $35 million “crown jewel” litigation in Houston. It is beyond unreasonable for a SEC filer to include unproven and baseless allegations in a civil matter - as part of their net asset value attributable to shareholders. In my view, the lack of financial integrity exhibited by Mr. Haddock and his SSP colleagues in their various disclosures is alarming.

§ With respect to Southern Star, SSP acquired Southern Star for $3 million from Lou Fox, SSP’s long-time CFO and the former general counsel and CEO. We believe that SSP threatened litigation against the former general counsel and CEO and settled for $150,000. Mr. Fox has not been forthcoming about his financial interest in Southern Star. Accordingly, Mr. Fox’s comments about my performance and the alleged deferred maintenance issue should be entirely discounted. Likely, Mr. Fox will do or say any anything to appease Mr. Haddock and his SSP colleagues.

§ I would also note, SSP’s disclosures regarding Southern Star have been all over the place. SSP appears to have mismanaged the Southern Star properties. Yet, Mr. Haddock and his SSP colleagues made public statements indicating they value the Southern Star assets at $30 million. In my view, the lack of financial integrity and inconsistency exhibited by Mr. Haddock and his SSP colleagues in their various disclosures is alarming.

§ Lastly, as part of my forced departure Mr. Haddock and his SSP colleagues made various claims and assertions about my conduct including related party transactions. Ironically, Mr. Haddock was eventually forced to acknowledge a conflict of interest with respect to his personal investment in Southern Star. Mr. Fox has not been forthcoming about his financial interest in Southern Star. Mr. Haddock’s rapacity is shameful. He has one set of rules for himself and another standard for everyone else.

Again, this communication is in support of the proxy materials you have received and in response to the overwhelming feedback from SSP shareholders. Many SSP shareholders have indicated that they prefer immediate liquidity and a return of capital over the unacceptable performance of Mr. Haddock and his SSP colleagues and their ill-conceived, poorly executed and failed New Direction Plan. I also want to reiterate my efforts to restore shareholder value, provide a sensible path forward including providing financial transparency for SSP shareholders.

SSP shareholders have a stark choice. Please vote in support of Longnecker, Thomas and me - the directors I have nominated. Mr. Haddock and his SSP colleagues’ conduct suggests a lack of judgment and fundamental misunderstanding of the market. Their baseless and contradictory statements are a clear attempt to mislead and deflect personal accountability. If

successful, we will restore shareholder value, monetize assets and return capital to SSP shareholders. Please vote for the Hartman nominated board nominees and make sure your voice is heard.

Once again, thank you for your feedback and support. Hopefully, this letter and my plan are clear evidence I have heard you. You prefer liquidity and the return of your capital. With God’s guidance, we will make this a reality. Together, we will achieve victory!

Please contact our team at IR@hartman-investments.com to provide updated contact information.

Sincerely, Al Hartman

CEO & President

Source:

https://www.sec.gov/Archives/edgar/data/831616/000110465925056822/tm2517282d1_ex99-1.htm

Member discussion