Inspirato (ISPO): Stoney Lonesome HF Opposes Buyerlink Merger, Urges Board to Pursue $3.15/Share Cash Offer from Exclusive Investments

Inspirato Incorporated

1544 Wazee Street

Denver, Colorado 80202

Attention: Special Committee of Board of Directors

Dear Members of the Special Committee,

Stoney Lonesome HF LP and certain of its affiliates (collectively, “Stoney Lonesome” or “we”) are significant minority stockholders of Inspirato Incorporated (“Inspirato” or the “Company”), collectively owning approximately 5.4% of the Company’s outstanding shares. While we recently made our intention to vote against the ill-conceived proposed reverse merger (the “Proposed Merger”) between Inspirato and Buyerlink Inc. (“Buyerlink”) clear in a presentation issued on September 2, 2025, we felt it was necessary to write directly to the Special Committee of the Board of Directors of the Company (the “Board”) in light of the $3.15 per share all-cash offer the Company received from Exclusive Investments, LLC (“Exclusive Investments”) late last week. To be clear, we believe the Proposed Merger with Buyerlink is a fundamentally flawed transaction that prioritizes the interests of Inspirato’s Chairman and CEO Payam Zamani over those of minority stockholders and exposes stockholders to a volatile and declining business in Buyerlink. As such, we consider the all-cash offer from Exclusive Investments to be a superior alternative, providing immediate value and avoiding the risks of holding shares in a potentially failing conglomerate. We implore the Special Committee to engage with Exclusive Investments immediately in accordance with its fiduciary duties.

Background and Initial Concerns

We invested in Inspirato due to our confidence in its subscription-based business model and its compelling value proposition as a long-term customer. Once the Proposed Merger was announced, we communicated to CEO Zamani our unequivocal opposition to owning 87% of Buyerlink and only 13% of Inspirato if the transaction is consummated. We believe the proposed structure of the transaction would result in stockholders holding illiquid common stock in a conglomerate with poor corporate governance, subordinated to over $90 million in preferred stock and debt. This junior security places minority stockholders, including ourselves, at a significant disadvantage. During a call with CEO Zamani and Michael Arthur, the CFO of Inspirato, we expressed our views that minority stockholders will reject the Proposed Merger, particularly as it appears structured as a take-private deal disguised as a merger, potentially exploiting recent changes in Delaware law and attempting to bypass a majority-of-minority vote. CEO Zamani’s response, while three representatives of Stoney Lonesome were on the line, was dismissive, stating, “I don’t give a shit about the minority stockholders. The minority stockholders don’t matter.” This blatant disregard for stockholder interests is deeply concerning and underscores the need for enhanced scrutiny of the Proposed Merger.

Efforts to Engage the Special Committee

Despite repeated efforts to engage directly with members of the Special Committee to discuss our significant concerns, we have only received general acknowledgements of our outreach and no opportunity for discussion. This lack of engagement further erodes our confidence in the governance process surrounding the Proposed Merger and underscores the need for us to publicly write to the Special Committee today.

Proxy Vote and Opposition

On September 6, 2025, we received a copy of Inspirato’s definitive proxy statement in connection with the Proposed Merger (the “Proxy Statement”). We voted AGAINST all of the proposals in connection with the Proposed Merger as follows:

· AGAINST Proposal 1, which would result in the issuance of 73,941,230 shares of Inspirato Class A common stock and 8,262,327 shares of Inspirato preferred stock pursuant to the Proposed Merger, representing a cumulative 659% increase in outstanding shares, significantly diluting existing stockholders.

· AGAINST Proposal 2, which would increase the authorized share capital necessary to facilitate the Proposed Merger.

· AGAINST Proposal 3, which would effect a reverse stock split and does nothing to address the fundamental flaws of the Proposed Merger.

· AGAINST Proposal 4, which would approve an adjournment of the upcoming special meeting to allow the Company to solicit additional support for the proposals needed to effect the Proposed Merger, which we believe would waste additional time and resources for a transaction disfavored by stockholders.

Concerns About Buyerlink’s Business and Valuation

The consideration offered in the Proposed Merger—primarily shares in Buyerlink, a company with a questionable track record and precarious financial outlook—is completely unacceptable in our view. Below we provide historical and financial context to illustrate why we believe Buyerlink is an unsuitable partner for Inspirato:

- Buyerlink’s Troubled History

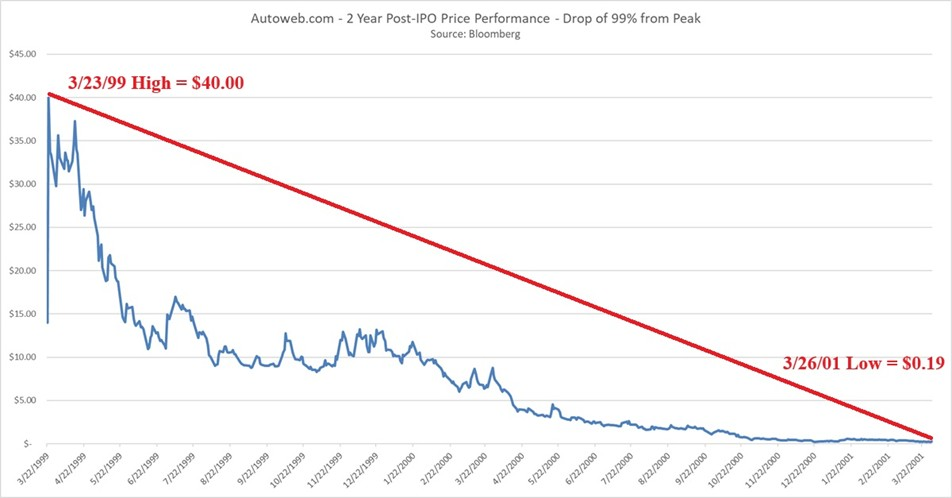

CEO Zamani’s LinkedIn profile touts Buyerlink’s predecessor, Autoweb, Inc. (“Autoweb”), a company he was CEO of at the time as having one of the most successful IPOs in NASDAQ history in 1999. In reality, Autoweb’s IPO was followed by a collapse within 20 months, with the company running out of cash and stockholders losing over 96% of their investment when it was sold for pennies on the dollar. It appears CEO Zamani sold stock during the IPO and left the company shortly thereafter, leaving investors to bear the losses. This history raises serious concerns about his leadership and commitment to stockholders.

- Overstated Valuation

In 2022, CEO Zamani acquired Autoweb, the core of Buyerlink’s business, for $5.5 million, at a multiple of less than one-tenth of its trailing revenue. In a July 2024 Business Insider interview, CEO Zamani claimed his entire estate (which includes Buyerlink, of which he owns and controls) was worth possibly more than $100 million, a valuation that appears inflated given recent multiple compressions in software and lead generation sectors due to AI disruption. Yet, less than a year later, the Proposed Merger assigns Buyerlink a $326 million equity value based on projections that we believe are unrealistic and unsupported by performance. According to the Proxy Statement, Buyerlink’s 2025 first-half (H1) results show only 43% of projected annual revenue and 35% of projected adjusted EBITDA achieved against the full year projections provided. For a business with minimal seasonality, as confirmed by CFO Arthur, achieving the implied second-half (H2) growth—30.6% year-over-year revenue growth and adjusted EBITDA margins of 30.6% (up 780 basis points from H1’s 21.7%)—appears highly improbable, as Buyerlink has never sustained margins above the low 20s.

3. Vulnerability to AI Disruption

Buyerlink’s lead generation business is inherently transactional, volatile, and increasingly threatened by AI-driven changes in search technology. Unlike Inspirato’s subscription-based model, Buyerlink operates in a commoditized market with declining relevance, making it, in our view, an ill-suited partner for a luxury travel brand.

Superior Alternative: Cash Offer from Exclusive Investments

On Friday, September 5, 2025, Inspirato filed a Form 8-K announcing that the Company received an all-cash offer from Exclusive Investments to acquire Inspirato for $3.15 per share on September 3, 2025. Exclusive Investments’ offer provides immediate liquidity and certainty of value to the Company’s stockholders, unlike the Proposed Merger, which would result in the Company’s stockholders effectively receiving shares in Buyerlink. In our view, receiving $3.15 per share in cash is far more preferable, which we believe is worth much more than an interest in Buyerlink pursuant to the Proposed Merger. We further believe that Inspirato would be better positioned to thrive as a luxury travel brand under Exclusive Investments’ ownership.

Lack of Diligence and Governance Concerns

In our view, the Special Committee and Board’s seeming persistence in hastily advancing the Proposed Merger, despite significant stockholder opposition and the availability of an all-cash offer, is troubling. The proposed issuance of preferred stock to CEO Zamani as part of the Proposed Merger, with substantial annual payments and priority over common stockholders, raises serious questions about conflicts of interest and corporate governance. Furthermore, the apparent lack of thorough due diligence by the Special Committee on Buyerlink’s business and projections (as illustrated by Buyerlink’s overstated valuation above) undermines the credibility of the merger process.

Conclusion

It is clear to us that the Proposed Merger with Buyerlink is a fundamentally flawed transaction that prioritizes the interests of CEO Zamani over those of minority stockholders and exposes stockholders to a volatile and declining business in Buyerlink. In our view, now that Inspirato has received a superior all-cash proposal from Exclusive Investments, we demand that the Special Committee act in accordance with its fiduciary duties and immediately engage with Exclusive Investments in order to maximize stockholder value. We are committed to ensuring that the Special Committee and the Board act in the best interests of ALL Inspirato stockholders, and we will not hesitate to take any actions that we believe are necessary to protect our fellow minority stockholders.

Sincerely,

Clint D. Coghill

Stoney Lonesome HF LP

cc: Michael Armstrong, director of Inspirato

Scott Berman, director of Inspirato

Ann Payne, director of Inspirato

May Samali, director of Inspirato

Julie Wainwright, director of Inspirato

Payam Zamani, Chairman and Chief Executive Officer of Inspirato

Source:

https://www.sec.gov/Archives/edgar/data/1820566/000092189525002547/ex991to13da214556002_090825.htm

Member discussion