Pacira (PCRX): DOMA Perpetual Capital Demands Immediate Sale Process Citing Overspending and Severe Underperformance

DOMA Perpetual Capital Management LLC

3350 Virginia Street

Suite 530

Miami, FL 33133

November 10th, 2025

To the Board of Directors of Pacira:

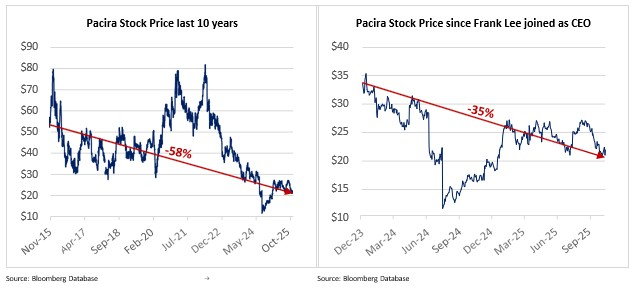

As you are aware, DOMA Perpetual has amended the 13D, stating our position regarding Pacira. Our ownership stake is now 6.8%.i We have also updated our intentions regarding our ownership. We continue to evaluate the possibility of substantially increasing our position in the future. Due to what we believe is management’s unrelenting underperformance, out-of-control spending, and lack of prudent financial control, we now believe Pacira’s Board should immediately hire bankers and conduct a formal sales process for the business.

We find Pacira’s continued lack of shareholder return unacceptable.ii The Board has allowed management to spend many millions of dollars in what we consider to be an ill-advised and wasteful manner, given Pacira’s financial performance.iii Further, we believe it was a mistake for the Board to move the company’s headquarters across the country, burning cash on new and expensive offices.iv As we see it, the executive stock-based compensation level is out of control relative to the company’s size. Full-year 2025 guidance indicates the stock-based compensation could amount to approximately 6% of Pacira’s market capitalization,v and year-to-date stock-based compensation is larger than the firm’s entire operating income.vi Our position is this represents a wholly irresponsible way to manage the company’s finances, and the Board must rectify this complete lack of prudent financial conduct.

Pacira’s management team has been paid tens of millions of dollars for a business plan which delivered dismal financial results and negative shareholder returns.vii Under current management, Zilretta sales have declined 2% year over year through Q3: another example of how poorly the business is being run.viii There are no justifications for why management and the Board should be allowed to continue to enrich themselves as they squander investors’ cash.

We believe a sale should be immediately pursued. Assuming a large buyer would likely cut all of the company’s SG&A and R&D spending and, modeling with high single digit revenue growth (which, under a much larger owner, we consider to be conservative, given the help of a larger sales teams, NOPAIN, and pricing power), the sum of those cash flows is potentially more than $10 billion through patent expiration. With that knowledge, we estimate a deal at around $2.7 billion valuation would be very doable and could lead to a valuation of approximately $66/share or more, depending on the number of shares outstanding. A sale price of roughly $66 per share represents about three times the current level, but is only around 15 times 2027 projected earnings if management completes the buyback without delay.ix In our view, this is not a stretched valuation for an acquisition.

Why should investors tolerate minimal returns if Pacira’s assets, and Exparel in paricular, are worth more than three imes the current stock price?

Exparel is a great product, not only in terms of safety and effectiveness, but also in the nature of the drug. The opioid epidemic in the US is costing the country billions of dollars and many thousands of lives.x Exparel is the leading non-opioid pain medication for use in surgical settings in the market.xi Under a larger company, the country may benefit from a faster expansion of Exparel and the chance for the product to quickly become the standard of care. We believe Exparel not only helps medical providers deliver better, safer health care, it lowers the cost of that care. Moreover, it can serve a vital role in managing the country’s opioid epidemic.

In our experience, under current management, shareholders only get excuses. Pacira’s underperformance is plainly visible in the company’s filings, and we believe its lavish spending is not a prudent way to operate Pacira’s revenues have increased 3% year over year, however, expenditures are rising at an exponential rate: R&D increased 36% year over year and SG&A increased 25% SG&A year over year.xii In an April 17th press release, the company pledged a commitment to efficiency and margin expansion at the pre-tax income level, which has yet to materialize.xiii Following that public statement, management took the company to losses at the pretax income level in Q2 and barely any profitability in Q3.xiv Management is not only underperforming, as shown in company sales and decreasing revenue guidance, but its out of control spending has left investors with marginal returns.xv Given these facts, we don’t see how management can continue to be trusted to generate shareholder return.

In addition to hiring bankers and conducting a formal sale process for the business, we assert these next steps should be taken:

- The Board and management must lay out a strategy to cut costs in order to enhance shareholder returns. Allowing spending to swell exponentially compared to revenue growth is fiscal recklessness. Moving forward, the company’s finances must be handled in a prudent manner.

- All M&A and new development programs that have not yet started must be put on hold. In prior private letters to the Board, we laid out how the Board destroyed shareholder value with the Flexion acquisition, an investment on which shareholders are still waiting to see any return. Before any further expansion of the pipeline, we believe the company should explore a sale.

- All free cash flow must be used for buybacks. Management needs to finish the $300 million share repurchase without delay, and a new $300 million buyback should be issued immediately after completing the current buyback program. For as long as the company trades at a large discount to its intrinsic value, buybacks should be the main focus of capital allocation.

Before the end of Q1 2026, bankers should conclude the process of pursuing a sale. In that time, if the price of the stock and the company’s results have already reached the potential purchase price, then – and only then – the sale might be postponed or reconsidered.

Why would board members not want to maximize shareholder return and hire bankers after this very visible muli-year underperformance? The only explanation we can think of is that they want to continue to receive their compensation from the firm and they are willing to ignore their legal and fiduciary duties to shareholders. Choosing to ignore shareholders’ concerns and continuing to defend the persistent multi-year underperformance and lack of shareholder returns is, we believe, tantamount to breaching these duties.

We have been communicating with the Board via private and public letters for over a year. It was a difficult process to get approval from this group for a simple, shareholder-friendly capital allocation framework, from which shareholders are now benefiting. It is obvious to us the $300 million share repurchase program and the smaller buyback before it materialized due to our consistent private and public demands.

In spite of the buyback announcement, the Board continues to dilute shareholders.xvi The Board’s decision to essentially print money by issuing shares, without shareholder approval for each increase, was another blow to stakeholders. Further, the Board’s actions demonstrate a critical lack of understanding of basic financial concepts. We think it is common fiscal sense that a company should not issue a convertible bond at the lowest valuation in its history when the business maintains plenty of free cash flow. In our view, the Board has yet to take action to protect shareholders’ interests or to create any tangible shareholder value, despite it being a core duty and obligation of all board members.

Management and the Board cannot be allowed to continue to collect millions of dollars in compensation from shareholders while continuing to underperform.xvii Pacira has spent nearly two years under the new CEO’s management and almost a year under NOPAIN coverage of Exparel. We have watched as the opportunity has been critically mismanaged. Pacira’s stock valuation is hovering near an all-time low, coupled with an absence of any financial or stock price returns.xviii As large stakeholders, we are tired of Pacira’s unrelenting underperformance and management’s continued excuses; shareholders have suffered enough.

Sincerely,

Pedro Escudero

CEO & CIO

DOMA Perpetual Capital Management LLC

Source:

https://www.sec.gov/Archives/edgar/data/1396814/000121465925016174/ex99_1.htm

Member discussion