Shah Capital (7.2% Stakeholder) Urges Novavax (NVAX) to Launch Strategic Review, Citing Persistent Failures and Governance Breakdown

October 13, 2025

Board of Directors of Novavax Inc.

21 Firstfield Rd.

Gaithersburg, MD 20878

Dear Directors,

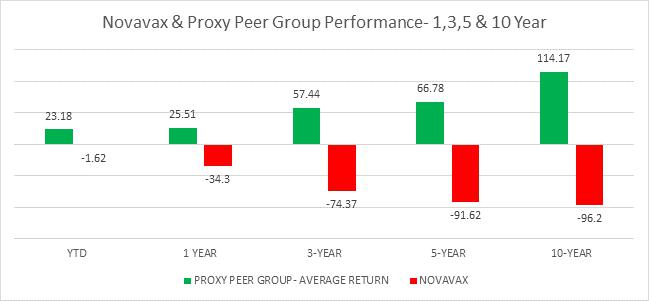

Shah Capital is Novavax’s 2nd largest and long-term shareholder, currently owning 11.8 million shares or 7.2% of the Company. Since our engagement with the company in March 2023, our concerns have accelerated with persistent underperformance, Nuvoxovid’s rollout slipups including this fall, timid/ineffective marketing, extremely poor capital market actions, and tremendous lack of accountability. Performance chart below speaks volumes on continued destruction of shareholder value even with the better efficacy/reactogenicity of its non-mRNA Covid vaccine and large twenty million safety database of Matrix-M adjuvant technology.

Performance data of NVAX & Proxy Peers as of 9/15/25, Source LSEG

History of Painful Regulatory, Marketing and Sales Fumbles Hindering Scientific Superiority

A recap of the litany of missteps that has severely damaged the company; missed FDA timelines, the 5-dose vial debacle in 2023 Fall Covid season, inadequate 3-month shelf-life for the Fall 2024 season, critical marketing slips resulting in miniscule 2% Covid vaccine market share in 2024 season despite Nuvaxovid having greater efficacy, tolerability and durability than peers. The recent supply issues to begin the 2025/2026 Covid rollout, and lack of effective marketing have allowed mRNA peers to get ~6 million shots already compared to Novavax’ non-existent ~7K as of 10/2/25.

Shah Capital finds it unfathomable why Nuvaxovid’s market share once again is non-existent given the scientific superiority (Utah Shield study) and positive regulatory tailwinds. New appointees at HHS/FDA/CDC have been mainly critical of mRNA vaccines, which should benefit Novavax’ “tried and true” traditional protein-based solution. With more states becoming increasingly averse to mRNA vaccines including Florida, Texas, Minnesota, Idaho, Iowa, Montana, South Carolina, Tennessee & Kentucky; some of which are trying to ban mRNA altogether, we find it inconceivable as to how management has been unsuccessful gaining meaningful share given the tens of millions of senior citizens/high risk/immunocompromised individuals in just those 9 states alone. Sales are miserable for the third consecutive year. Also, Nuvaxovid awareness continues to be alarmingly low as effective marketing and messaging could have Nuvaxovid market share closer to 40% given the above-mentioned positive tailwinds.

Shah Capital also sees significant edge for Novavax’ Combo or Covid/Flu program as mRNA competition may continue to have difficulty with tolerability due to the inherent enormous amounts of antigen required. Novavax’ protein-based technology does not have this limitation, which should help narrow the gap in terms of rollout timeframe and can prove to be more easily tolerated by patients. One year safety study published in June 2025 clearly showed lower SAE compared to its mRNA competition.

Questionable and Unfortunate August Convertible Refinancing

We are at a complete loss for an extremely expensive $225 million convertible bond refinance on August 21, 2025. With favorable upcoming fall Covid season considering all the negative noise around mRNA and company unleashed its blunder again bringing down investor confidence and trust. Keeping in mind around $400 million UK/GAVI liabilities over the next few years. Was this $150 million debt push out by few years necessary with so many positive catalysts including Combo and Matrix-M partnerships in the works, fall vaccine season was just weeks away, Sanofi Q4 2025 milestones on the way, and ~$900 million cash as of 6/30/25?

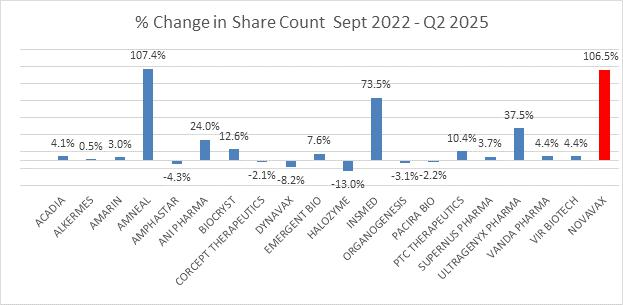

Dilution DNA induces High Short Interest

Since September 2022, Novavax outstanding share count has ballooned compared to proxy peer average of only 14%. The Board should have implemented aggressive cost-cutting measures earlier, as advised by Shah Capital in our March 2023 letter, rather than earning the title of ‘a dilutive king.'

Source: LSGE

2301 Sugar Bush Rd | Suite 510 | Raleigh, NC 27612 | 919-719-6360 | shahcapital.com

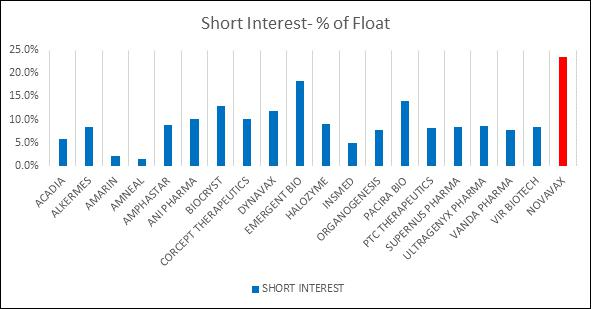

Perennial execution failures and ineffective leadership have taken their toll on investor confidence, allowing short sellers to pounce Novavax for years. Novavax short interest is ~25% compared to 9% average.

Short Interest Data as of 9/15/25, Source LSEG

Immediate Formal Strategic Review a MUST

Novavax shareholders deserve meaningful urgent action to reverse Novavax’ trajectory as one of the worst-performing pharma/biotech stocks of the past decade, down 95%. The massive underperformance is not the fault of biotech malaise, vaccine jitters, or market dynamics. Rather, it is the direct result of repeated strategic missteps, terrible execution on sales and marketing, and entrenched Board that has consistently refused to take responsibility for its failed execution. Novavax’ poor proxy approval results and current market value of less than $1.5 billion even with favorable regulatory environment clearly indicates Board and management have lost investor trust and confidence.

Shah Capital recommends an immediate formal strategic review for the sale of the company encompassing its extremely valuable Covid/Flu Combo vaccine, pipeline assets, and Matrix-M adjuvant technology. Novavax’s IP and scientific capabilities will have far greater upside potential in the hands of large capable pharma entity. The recent $10.5 billion respiratory acquisition had $3 billion peak sales expectations in 2029. Novavax’s Flu/Covid Vaccine with only one competitor may have higher peak sales in 2029 considering total combined flu/covid sales of $15 billion in 2024. Also, the regulatory tailwinds are tremendously in favor of non-mRNA vaccine solutions globally and Novavax is the biggest beneficiary!

Sincerely,

/s/ Himanshu H. Shah

Himanshu H. Shah

Source:

https://www.sec.gov/Archives/edgar/data/1000694/000139834425019099/fp0095822-1_ex991.htm

Member discussion